Understanding Pips in Forex Trading

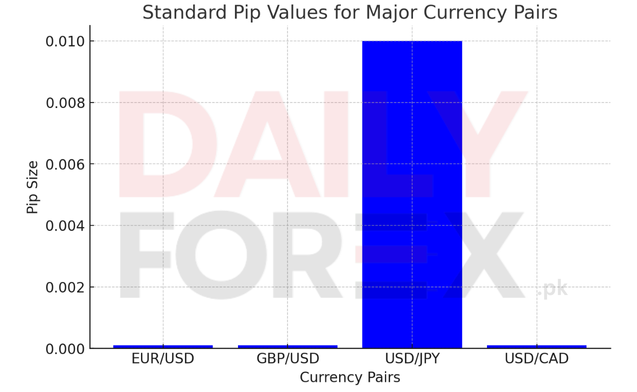

A pip (percentage in point) is the smallest price movement in the forex market, used to measure price changes between two currencies. Most currency pairs are quoted to four decimal places, meaning that one pip is equal to 0.0001. However, pairs involving the Japanese yen (JPY) are quoted to two decimal places, making one pip equal to 0.01.

📌 Example: If EUR/USD moves from 1.1050 to 1.1051, that 0.0001 increase is one pip.

What is a Pipette?

Some brokers offer quotes with additional precision, going to five and three decimal places instead of four and two. This fractional pip is called a pipette and is equal to one-tenth of a pip.

📌 Example: If GBP/USD moves from 1.30542 to 1.30543, that 0.00001 change is one pipette.

How to Calculate the Value of a Pip

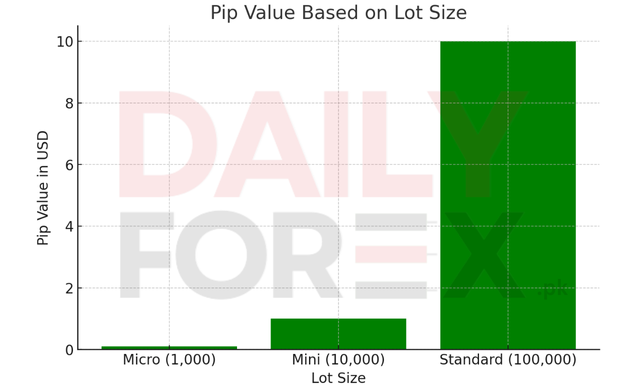

The value of a pip varies depending on the currency pair and lot size. Here’s how to calculate it:

Example 1: USD/CAD = 1.0200

A one-pip movement in a 10,000 unit trade changes the position value by $0.98.

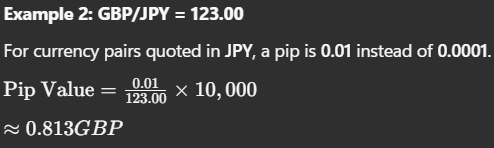

Example 2: GBP/JPY = 123.00

For currency pairs quoted in JPY, a pip is 0.01 instead of 0.0001.

A one-pip movement in a 10,000 unit trade changes the position value by 0.813 GBP.

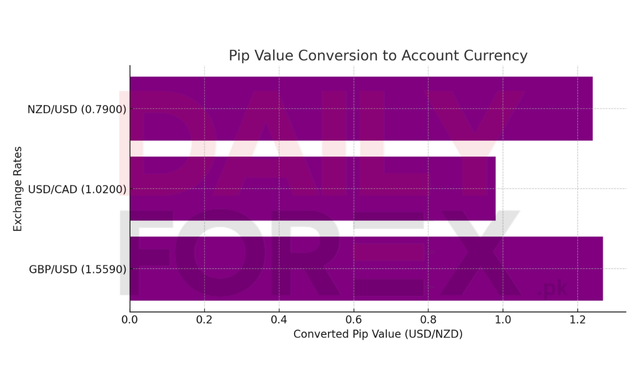

Finding Pip Value in Your Account’s Currency

Since forex is a global market, traders need to convert pip values into their account’s base currency.

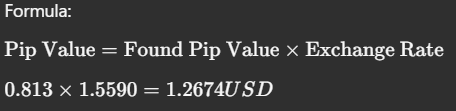

Example: Converting GBP Pip Value to USD

Using the GBP/JPY example, let’s convert the pip value from GBP to USD using an exchange rate of GBP/USD = 1.5590.

So, a 0.01 pip movement in GBP/JPY affects the trade by $1.27 USD.

Example: Converting USD Pip Value to NZD

For USD/CAD, we convert pip value from USD to NZD using an exchange rate of NZD/USD = 0.7900.

A 0.0001 pip movement in USD/CAD affects the trade by 1.24 NZD.

Why Understanding Pips Matters?

✅ Calculating profit and loss accurately ✅ Understanding trade size impact on account balance ✅ Managing risk with proper lot sizing

Most forex brokers automatically calculate pip values, but knowing how it works helps traders optimize risk management.

🚀 Want an easier way? Use the Pip Value Calculator on DailyForex.pk!