Swiss Franc Strengthens Amid Geopolitical Tensions and Fed Uncertainty

The USD/CHF pair continues to decline, trading near 0.9030 in the early European session on Wednesday, as investors seek refuge in safe-haven assets like the Swiss Franc (CHF). Rising geopolitical tensions, particularly uncertainty surrounding the Russia-Ukraine peace talks, are fueling demand for CHF, weighing on the U.S. Dollar (USD).

Meanwhile, traders are eagerly awaiting the release of the Federal Open Market Committee (FOMC) meeting minutes, scheduled for later today. The minutes could provide critical insights into the Federal Reserve’s stance on interest rates, which may determine the USD’s next move.

📢 Stay updated with real-time forex insights on DailyForex.pk

USD/CHF Technical Analysis – Key Support & Resistance Levels

📊 Technical Indicators Suggest Continued Bearish Momentum

✅ USD/CHF remains below 0.9050, indicating selling pressure.

✅ Safe-haven demand for CHF remains high, keeping USD under pressure.

✅ Potential volatility expected following FOMC minutes release.

📉 Support Levels to Watch:

- 0.9020 – Initial support zone.

- 0.9000 – Psychological round level.

- 0.8980 – Key technical floor.

📈 Resistance Levels to Watch:

- 0.9050 – Immediate resistance level.

- 0.9085 – Next key resistance.

- 0.9100 – Psychological barrier for buyers.

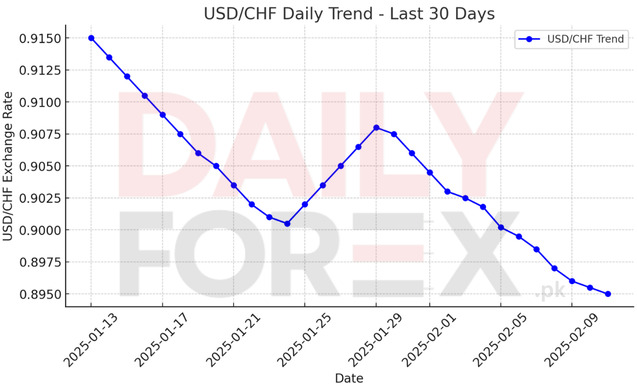

📊 Now, let’s analyze USD/CHF’s daily price trend. 📈

Market Outlook – Key Drivers for USD/CHF

📌 Swiss Franc Gains as Investors Seek Safe-Haven Assets

- Russia-Ukraine tensions escalate, leading investors to diversify into CHF for stability.

- Ukrainian President Zelenskiy’s remarks on peace negotiations added uncertainty, further boosting CHF.

- Any increase in geopolitical risk could strengthen CHF further and push USD/CHF lower.

📌 FOMC Minutes to Provide Direction for USD

- The Federal Reserve remains cautious on rate cuts, with San Francisco Fed President Mary Daly stating that 2025 rate adjustments remain uncertain.

- The NY Empire State Manufacturing Index rebounded to 5.7, signaling resilience in the U.S. economy.

- If FOMC minutes reveal a hawkish outlook, USD may regain strength, limiting CHF’s gains.

📢 Follow live forex updates on DailyForex.pk

Conclusion – What’s Next for USD/CHF?

The USD/CHF pair remains under selling pressure, as geopolitical instability drives demand for CHF. The upcoming FOMC minutes release will determine whether USD finds support or continues its decline.

💡 Market Outlook:

✅ If CHF demand persists, USD/CHF could break below 0.9000.

✅ A hawkish Fed stance may help USD reclaim levels above 0.9050.

✅ Traders should watch risk sentiment and Fed commentary closely.

📢 For daily forex forecasts, visit DailyForex.pk