Fibonacci retracement levels are among the most popular tools used by forex traders to predict potential price reversals in trending markets. Whether you’re riding a bullish trend or catching a retracement in a bearish move, these horizontal lines can help you identify possible entry or exit points with greater confidence.

But how exactly do they work, and how can you apply them effectively in your trading strategy?

Let’s break it down.

What Are Fibonacci Retracement Levels?

Fibonacci retracement levels are horizontal support and resistance levels derived from the famous Fibonacci sequence. They help traders forecast where the price might pull back to before continuing in the direction of the trend.

The key Fibonacci levels used in forex trading are:

- 23.6%

- 38.2%

- 50.0% (not officially a Fibonacci number, but commonly used)

- 61.8%

- 76.4%

These levels act as potential price zones where buyers or sellers may step in, creating turning points in the market.

When to Use Fibonacci Retracement Levels

Fibonacci retracement tools are most effective when the market is trending.

- In an uptrend: Look for buying opportunities at Fibonacci support levels.

- In a downtrend: Look for selling opportunities at Fibonacci resistance levels.

These levels serve as a predictive technical indicator, meaning they help estimate future price behavior based on past swing highs and lows.

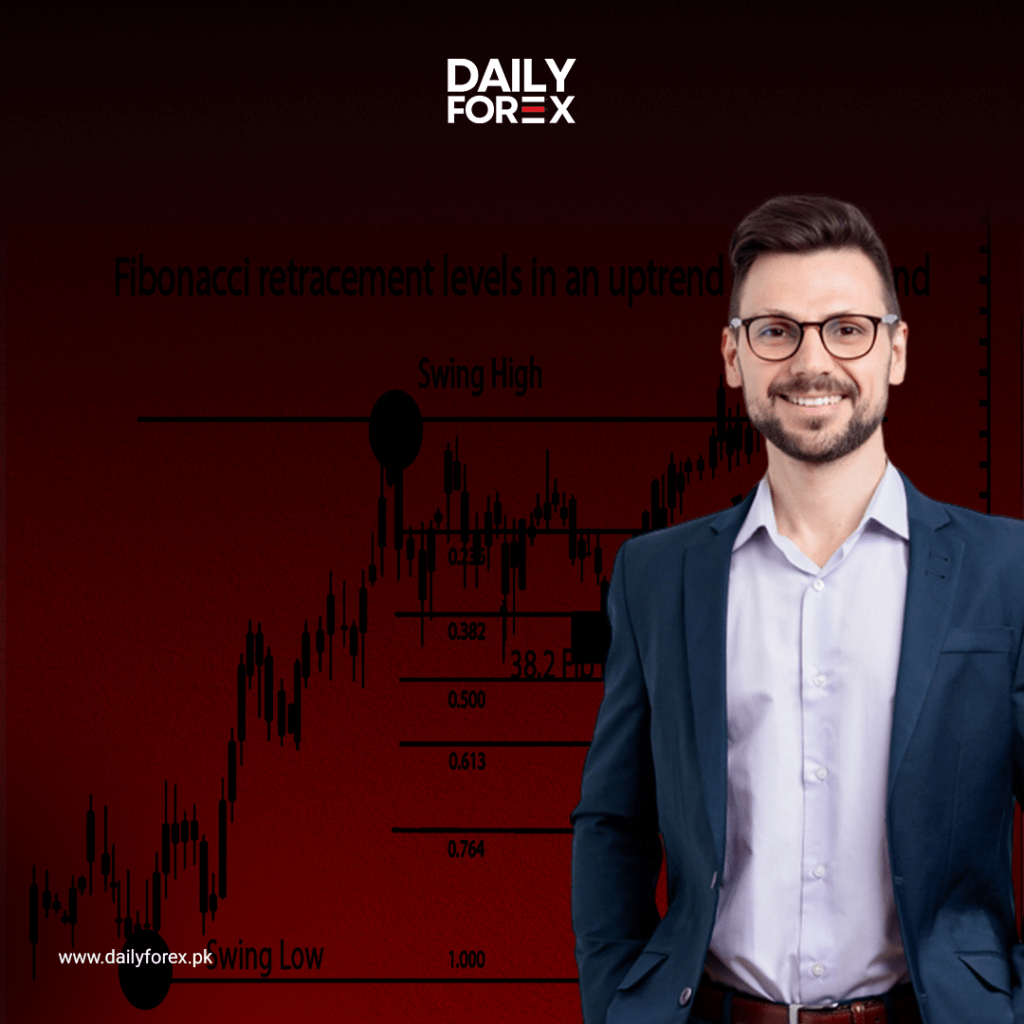

How to Plot Fibonacci Retracement Levels

Here’s how to draw Fibonacci levels correctly:

- For uptrends: Identify a significant Swing Low, then drag your Fibonacci tool to the most recent Swing High.

- For downtrends: Do the opposite. Start from the Swing High and drag it to the most recent Swing Low.

Now let’s look at two real-world examples using AUD/USD and EUR/USD charts.

Example 1: Using Fibonacci in an Uptrend (AUD/USD)

📈 Chart: AUD/USD Daily

- Swing Low: 0.6955 (April 20)

- Swing High: 0.8264 (June 3)

The Fibonacci tool plots the following levels:

- 23.6% – 0.7955

- 38.2% – 0.7764

- 50.0% – 0.7609

- 61.8% – 0.7454

- 76.4% – 0.7263

▶ What happened?

Price pulled back past the 23.6% level, found support at the 38.2% level, and bounced back up, eventually breaking the previous high. Traders who went long at the 38.2% retracement would have captured significant pips on the rebound.

Example 2: Using Fibonacci in a Downtrend (EUR/USD)

📉 Chart: EUR/USD – 4 Hour

- Swing High: 1.4195 (January 25)

- Swing Low: 1.3854 (February 1)

The Fibonacci retracement tool generated:

- 23.6% – 1.3933

- 38.2% – 1.3983

- 50.0% – 1.4023

- 61.8% – 1.4064

- 76.4% – 1.4114

▶ What happened?

Price tried to rally and initially paused at the 38.2% level. Eventually, it tested and respected the 50.0% level as resistance before continuing lower. This created a solid short opportunity for those watching the Fib levels.

Do Fibonacci Levels Always Work?

Not always. While these levels are widely used and often respected due to their popularity, they are not foolproof. Think of them as areas of interest—not exact reversal zones.

Price may:

- Slightly overshoot a level

- Ignore it completely

- Consolidate around it

This is why Fibonacci retracement levels are best used alongside other tools like trendlines, candlestick patterns, or support and resistance zones.

Final Thoughts: Tips for Using Fibonacci Retracement

- Use Fibonacci retracement only when the market is trending.

- Combine it with candlestick confirmation and volume analysis.

- Don’t forget to set your stop-loss just beyond the retracement level to manage risk.

- Understand that Fibonacci tools are subjective and can vary depending on the swing points selected.

🚀 Ready to Master Fibonacci Trading?

Fibonacci levels are a powerful ally in your forex trading arsenal—when used correctly. Practice spotting high-probability swing highs and lows, and always pair Fibonacci levels with other confluences for optimal results.

Stay tuned for our next guide on Fibonacci Extensions—perfect for identifying profit targets and maximizing your trades!

📍 Visit www.dailyforex.pk for more Forex trading strategies, technical analysis tutorials, and daily market insights!