The Spent Output Profit Ratio (SOPR) is a powerful on-chain metric used by Bitcoin and cryptocurrency traders to determine whether holders are selling their coins at a profit or loss.

It helps answer this key question:

👉 Are investors cashing out in profit or cutting losses?

By analyzing on-chain transactions, SOPR reveals investor sentiment and highlights potential trend reversals before they show up in price charts.

🧠 SOPR Definition

SOPR = Selling Price / Buying Price

More precisely:

SOPR is calculated by dividing the price of coins at the time they were spent (or moved) by the price at which they were originally acquired.

- SOPR > 1 → Coins are sold at a profit

- SOPR < 1 → Coins are sold at a loss

- SOPR = 1 → Coins are breaking even

🟠 How SOPR Works

When a holder moves their Bitcoin, the blockchain records the transaction. SOPR tracks the difference between the value at the time of acquisition vs the value when it’s spent.

This lets analysts determine:

- Are people realizing profits?

- Are they panic selling?

- Is the market cooling off or heating up?

📊 SOPR in Market Trends

🔼 SOPR Above 1 → Bullish Signal

If SOPR consistently stays above 1:

- Most sellers are in profit.

- Indicates a healthy, bullish market.

- Suggests confidence among investors.

🔽 SOPR Below 1 → Bearish Signal

If SOPR falls below 1:

- Majority are selling at a loss.

- Suggests fear or capitulation.

- Can mark bottoming phases in bear markets.

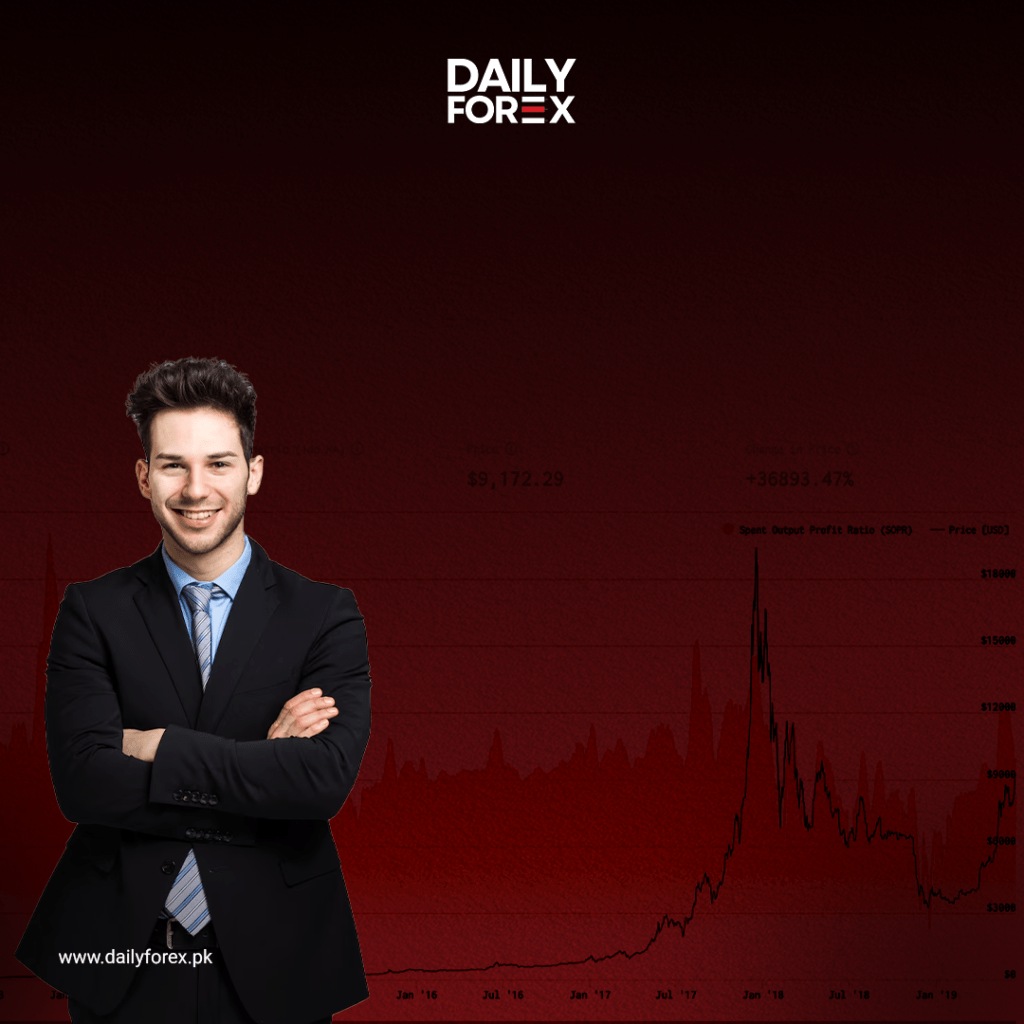

📈 SOPR Chart Interpretation

On a standard SOPR chart, you’ll usually see:

- Orange line: SOPR value

- Black line: BTC price

Key Zones:

- Above 1.0: Profit-taking zone

- Below 1.0: Loss realization zone

- Bounce from 1.0: Bullish confirmation

- Rejection at 1.0: Bearish rejection or sell pressure

🧩 SOPR Reset and Trend Reversals

A concept known as “SOPR reset” is often used by traders:

- When SOPR dips to ~1.0 during a bull market and bounces, it shows that investors are not willing to sell at a loss, which is a bullish signal.

- When SOPR fails to recover above 1.0 in a downtrend, it suggests continued weakness and further price correction.

This makes SOPR useful for spotting mid-cycle pullbacks, local bottoms, and bull/bear reversals.

🔍 Variants of SOPR

- Adjusted SOPR (aSOPR)

Filters out very short-term movements (coins moved within 1 hour) to reduce noise. - Entity-Adjusted SOPR

Groups addresses by ownership (entities), offering a cleaner signal by avoiding double-counting.

🧠 Why SOPR Matters for Traders

✅ Confirms profit-taking zones

✅ Helps detect panic selling phases

✅ Signals potential bottoms and market reversals

✅ Complements price action and RSI/MACD indicators

✅ Useful in both bull and bear markets

🧠 Pro Tips for Using SOPR

- Combine SOPR with metrics like NUPL, MVRV, and on-chain volume for confirmation.

- Watch for SOPR trending above or below 1.0 after major events like ETF approvals, interest rate hikes, or regulatory news.

- Use SOPR divergence from price for early signals of trend reversals.

Final Thoughts

SOPR is one of the most insightful on-chain tools available to crypto traders.

It tells the real story behind the price — whether investors are optimistic or giving up.

Understanding SOPR can help you:

- Time your entries and exits better

- Avoid buying into euphoria

- Spot hidden market shifts before they’re obvious

✅ Want more insights like this?

Check out our full crypto education section on www.dailyforex.pk, where we break down technical, fundamental, and on-chain tools to make you a smarter trader.