The Pakistani Rupee (PKR) opened Wednesday’s trading session with a slight depreciation against the US Dollar (USD), following a marginal appreciation in the previous day’s interbank market. The open market continued to reflect a premium over interbank rates, indicating sustained demand for physical USD.

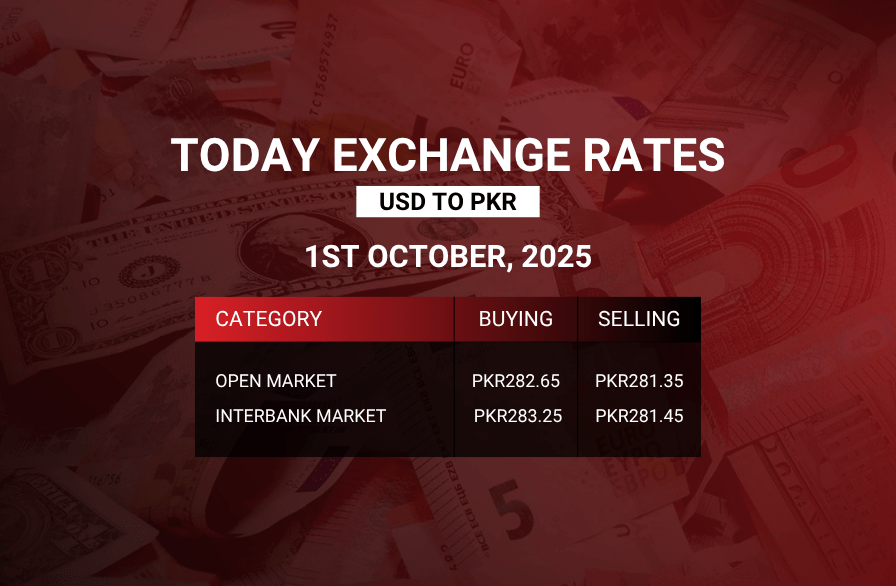

🏦 Interbank Market – Opening Rates

- Buying Rate: PKR 281.35

- Selling Rate: PKR 281.45

Market Insight:

The interbank market opened with a narrow spread of PKR 0.10, suggesting balanced liquidity conditions. The slight depreciation of the PKR indicates moderate demand for USD in formal banking channels, with minimal volatility observed at the start of the trading day.

💵 Open Market – Opening Rates

- Buying Rate: PKR 282.65

- Selling Rate: PKR 283.25

Market Insight:

The open market opened with a consistent premium over interbank rates, reflecting continued demand for physical USD. Retail buyers, importers, and remittance recipients contribute to this ongoing premium, signaling healthy market activity.

📊 Opening Rate Comparison

| Market Segment | Buying Rate | Selling Rate | Spread | Premium vs Interbank |

|---|---|---|---|---|

| Interbank | 281.35 | 281.45 | 0.10 | — |

| Open Market | 282.65 | 283.25 | 0.60 | ~PKR 1.30 |

🔍 Market Outlook

- Interbank Market: The PKR’s slight depreciation reflects moderate demand for USD in formal banking channels.

- Open Market: The consistent premium over interbank rates indicates ongoing demand for physical USD, driven by import activities and cash transactions.

- Investor Advisory: Market participants are advised to monitor global economic indicators and domestic fiscal policies, as these factors could influence the USD/PKR exchange rate in the near term.

📌 For real-time updates, expert analysis, and detailed forex coverage, visit www.dailyforex.pk.