USD/CAD Struggles Below 100-Period EMA, Bearish Pressure Builds

The USD/CAD pair remains under pressure, hovering near 1.4205 during the early European session on Tuesday. While the U.S. Dollar (USD) maintains strength, the pair’s bearish technical setup suggests further downside potential.

With Canadian Consumer Price Index (CPI) inflation data set for release today, traders are positioning for volatility in the USD/CAD exchange rate. The CPI inflation rate for January is expected to increase to 1.8% YoY, with a 0.1% MoM rise, up from December’s -0.4% contraction.

📢 Get real-time forex insights on DailyForex.pk

USD/CAD Technical Analysis – Key Levels to Watch

📊 Technical Indicators:

✅ USD/CAD remains below the 100-period EMA, reinforcing a bearish trend.

✅ RSI stands at 46.25, indicating continued downward momentum.

✅ Support & resistance levels dictate short-term direction.

📉 Support Levels to Watch:

- 1.4151 – February 14 low (first downside target).

- 1.4130 – Lower Bollinger Band limit.

- 1.4100 – Psychological support level.

📈 Resistance Levels to Watch:

- 1.4265 – Immediate resistance (upper Bollinger Band boundary).

- 1.4310 – Next resistance (100-period EMA).

- 1.4380 – February 10 high (extended bullish target).

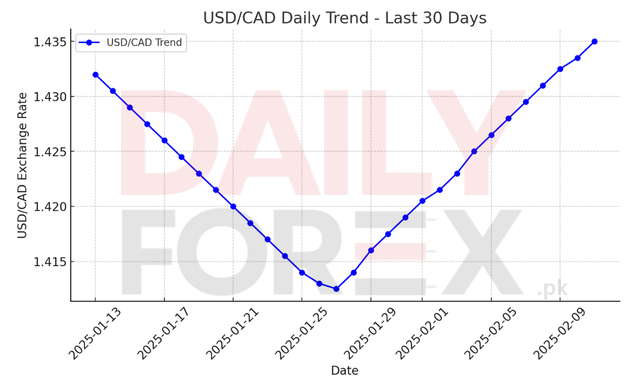

📊 Now, let’s visualize the daily USD/CAD trend. 📈

Fundamental Overview – Market Drivers for USD/CAD

📌 Canadian CPI Inflation Report in Focus

- The Canadian Consumer Price Index (CPI) for January is forecasted to rise 1.8% YoY, with a 0.1% MoM increase from December’s -0.4% drop.

- A higher-than-expected inflation print could strengthen the Canadian Dollar (CAD) as it may reinforce expectations of a more hawkish Bank of Canada (BoC).

- A weaker CPI reading may weigh on the CAD, allowing USD/CAD to recover above resistance levels.

📌 USD Strength & Interest Rate Expectations

- The U.S. Dollar (USD) remains firm, supported by rising Treasury yields and expectations of prolonged higher Fed rates.

- Any hawkish signals from the Federal Reserve could boost USD/CAD despite the current bearish trend.

📌 Crude Oil Prices & Impact on CAD

- As Canada is a major oil exporter, fluctuations in crude oil prices affect CAD valuation.

- A rebound in oil prices could support CAD strength and push USD/CAD lower.

📢 Follow live USD/CAD market updates on DailyForex.pk

Conclusion – What’s Next for USD/CAD?

The USD/CAD pair remains bearish, trading below the 100-period EMA and pressured by a weak RSI reading. Canadian CPI data will determine whether CAD strengthens further or USD/CAD finds support at lower levels.

💡 Market Outlook:

✅ A break below 1.4151 could lead to 1.4130 and 1.4100 downside targets.

✅ If CPI disappoints, USD/CAD may rebound towards 1.4265 and 1.4310 resistance levels.

✅ Oil price volatility and Fed expectations remain key catalysts for directional movement.

📢 For daily forex forecasts, visit DailyForex.pk