March 1st, 2025 | Daily Forex Pakistan

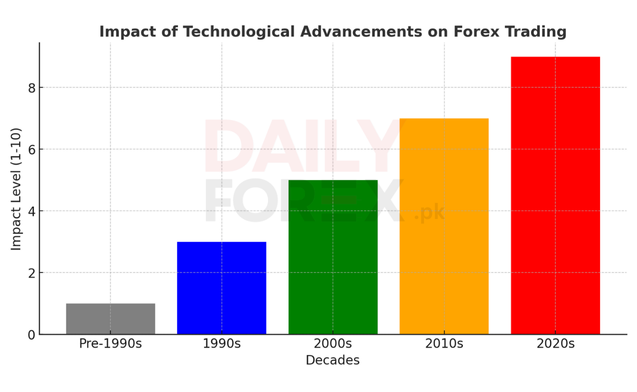

The forex market, once reserved for institutional investors, has transformed into a globally accessible trading arena. Technological advancements have dismantled barriers that once kept retail traders out. Today, anyone with an internet connection can participate in currency trading.

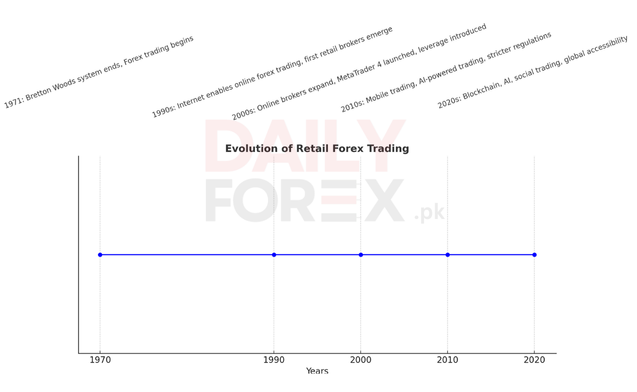

A Journey Through Retail Forex Trading’s Evolution

Retail forex trading has evolved from a restricted financial market into one of the most dynamic investment opportunities. This transformation spans several decades, each marked by significant advancements and breakthroughs.

The Early Days: When Forex Was Reserved for Institutions

Post-Bretton Woods: The Birth of Modern Forex Trading

Forex trading, as we know it today, began in the 1970s. The abandonment of the Bretton Woods system in 1971 led to floating exchange rates, paving the way for currency speculation.

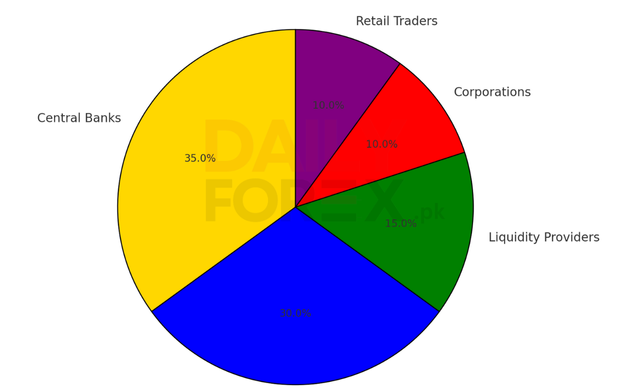

Initially, forex trading was exclusive to banks, hedge funds, and multinational corporations. Individual traders were unable to access the interbank market due to multiple barriers:

- High Capital Requirements – Trading required millions of dollars, making it unattainable for retail traders.

- Limited Access – Transactions occurred over telephone and telex, slowing the process and making real-time trading inefficient.

- Lack of Technology – Without online platforms, trading was restricted to large financial institutions.

Retail forex trading was virtually nonexistent at this stage, leaving small investors without opportunities to participate.

The 1990s: The Internet Revolution Opens the Doors

The rise of the internet in the 1990s transformed forex trading. Major banks began developing electronic platforms for institutional clients, enabling real-time exchange rate access and instant trade execution.

At the same time, independent forex brokers emerged. These brokers introduced online trading platforms, allowing retail traders to enter the market. The following key changes revolutionized retail forex trading:

- Lower Capital Requirements – Traders could start with as little as a few hundred dollars instead of millions.

- Smaller Trade Sizes – Brokers introduced mini (10,000 units) and micro (1,000 units) lots, making trading more accessible.

- Online Trading Platforms – Retail traders gained access to real-time charts, analysis tools, and automated trading features.

The introduction of leverage further accelerated retail forex trading. Traders could now control large positions with a relatively small capital investment.

The 2000s: The Boom of Online Forex Trading

The early 2000s witnessed a surge in retail forex trading, driven by rapid technological advancements and financial globalization. Several key milestones defined this era:

Emergence of User-Friendly Trading Platforms

In 2005, the launch of MetaTrader 4 (MT4) revolutionized trading. This platform provided advanced charting tools, technical indicators, and automated trading strategies. It quickly became the industry standard, followed by MetaTrader 5 (MT5) and cTrader.

Increased Accessibility Through Mobile Trading

The introduction of mobile trading apps allowed traders to analyze markets and execute trades on the go. This further expanded participation in forex trading.

A More Competitive Broker Landscape

As competition among brokers intensified, trading conditions improved. Retail traders benefited from tighter spreads, lower fees, and enhanced customer support.

Availability of Demo Accounts

For the first time, new traders could practice risk-free trading with demo accounts. This helped them develop strategies before committing real money, significantly reducing learning barriers.

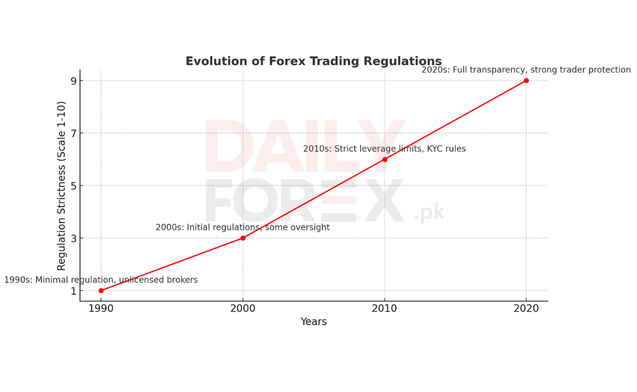

The 2010s: Regulation, Automation, and AI Trading

The 2010s marked a period of significant regulatory oversight and technological advancements. Several developments shaped this decade:

- Stricter Regulations – Regulatory bodies like the CFTC (USA), FCA (UK), ASIC (Australia), and ESMA (Europe) introduced measures to protect traders. These included leverage restrictions, negative balance protection, and transparent pricing.

- Algorithmic and AI Trading – Automated trading systems became more prominent. High-frequency trading (HFT) and AI-driven strategies improved market efficiency and execution speed.

- Social and Copy Trading – Platforms like eToro enabled traders to copy experienced professionals, making forex trading more accessible to beginners.

Regulations improved transparency, reducing the risk of scams and unethical broker practices.

The Present: A Fully Accessible Market with Advanced Tools

Retail forex trading has evolved into a highly accessible and technologically sophisticated market. Modern trading includes:

- Advanced Trading Platforms – AI-powered analytics, automation, and real-time news integration enhance trading decisions.

- Mobile and Cloud-Based Trading – Traders can manage their accounts from anywhere using mobile apps.

- Tighter Spreads and Zero Commissions – Increased competition has lowered trading costs.

- Global Trading Communities – Social trading networks and forums facilitate knowledge-sharing among traders.

Today, anyone can participate in forex trading, whether professionally or as a secondary investment opportunity.

What’s Next for Retail Forex Tradings?

The future of forex trading looks promising, with several trends shaping the market:

- Blockchain and Decentralized Trading – The integration of cryptocurrency and blockchain-based forex platforms is expected to rise.

- AI and Machine Learning – AI-driven analytics and automation will continue to refine trading strategies and risk management.

- Improved Regulatory Oversight – Financial authorities will implement more safeguards to protect retail traders and maintain market integrity.

Final Thoughts

The evolution of retail forex trading is a testament to how technology and market access have transformed financial markets. Once restricted to institutions, forex trading is now open to individuals worldwide.

With cutting-edge technology, robust regulations, and continuous innovations, retail traders today have more tools and opportunities than ever before. Whether you are new to forex or an experienced trader, staying informed and continuously learning will help you navigate this dynamic market successfully. For details visit: Daily Forex Pakistan🎯💹