Pivot points are a widely used technical analysis tool that help traders identify potential support and resistance levels in the market. They provide clear reference points that assist in planning entries, exits, stop-losses, and profit targets.

Calculated using the previous period’s high, low, and closing prices, pivot points can quickly highlight key price levels likely to trigger market reactions.

🧮 4 Major Types of Pivot Points

There are four commonly used methods to calculate pivot points:

- Standard Pivot Points

- Woodie Pivot Points

- Camarilla Pivot Points

- Fibonacci Pivot Points

Each method offers slightly different levels and trading insights. Try them out to find the one that fits your strategy best.

💡 Quick Tips for Pivot Point Trading

Master these simple tips to boost your pivot point trading:

- Pivot points often act as magnets for price. Most forex pairs oscillate between R1 and S1 levels.

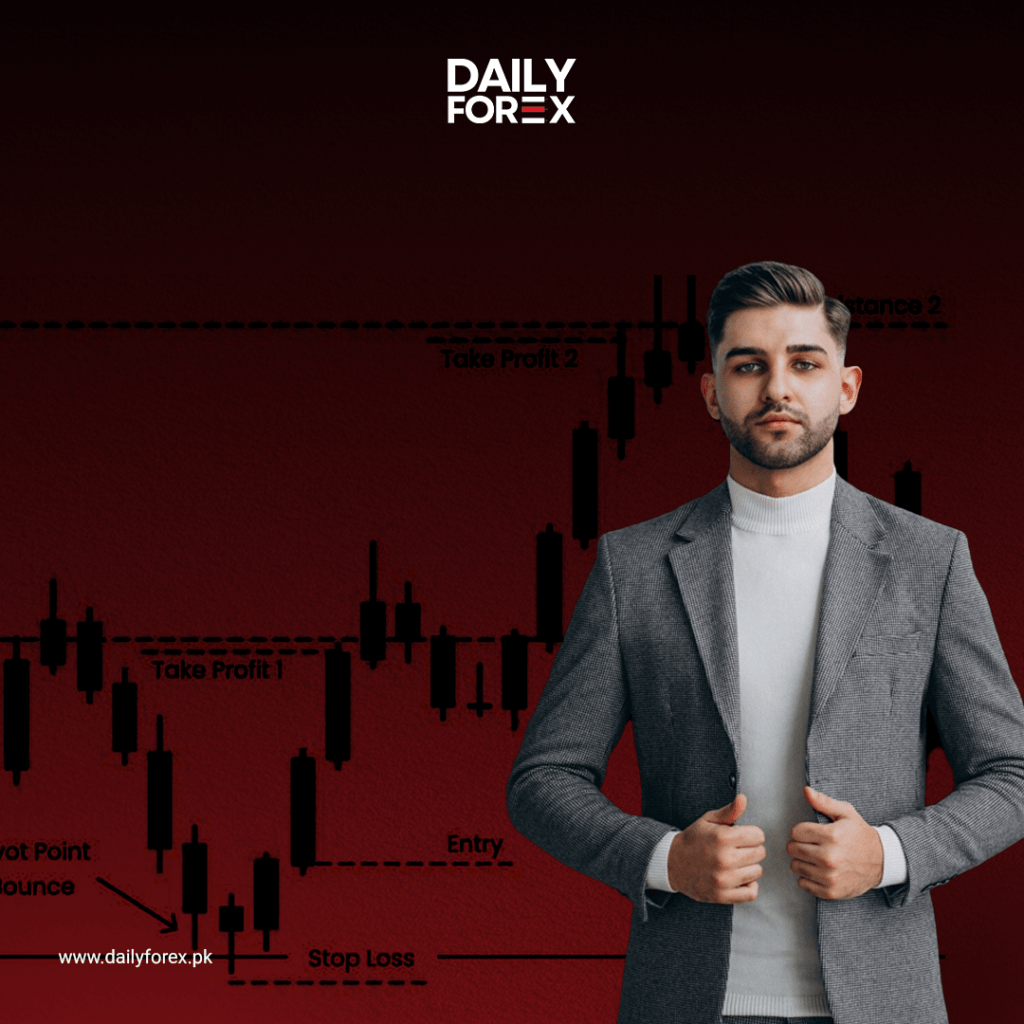

- You can trade reversals near these zones or breakouts when price breaches them.

- Range traders buy at support (S1, S2) and sell at resistance (R1, R2).

- Breakout traders wait for confirmation of price breaching these levels.

- Sentiment traders use the pivot point itself as a guide—above means bullish, below means bearish.

🔧 Pro Tip: Combine for Confirmation

Don’t rely solely on pivot points. Enhance your setup using:

- Candlestick patterns

- RSI and Stochastic indicators

- MACD or Moving Average crossovers

The more confirmations, the higher the probability of a profitable trade.

🧠 Test Your Knowledge

Want to see how well you understand pivot points?

👉 Take the Pivot Point Quiz to test your skills and reinforce your knowledge!

Stay Updated With Dailyforex.pk