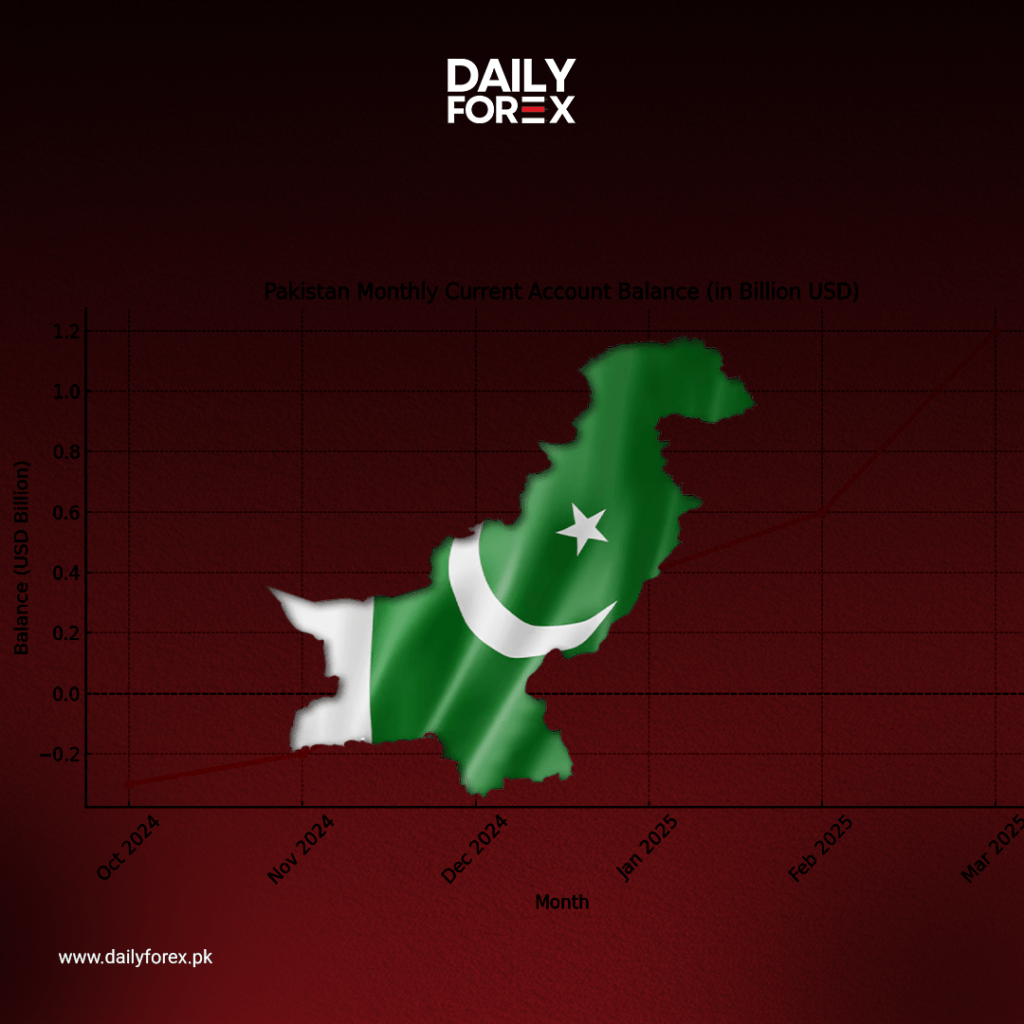

In a historic economic milestone, Pakistan has posted its largest-ever monthly current account surplus—a stunning $1.2 billion in March 2025, according to the latest data from the State Bank of Pakistan (SBP).

This marks a massive turnaround from February’s deficit of $97 million, and represents a year-on-year surge of 230%, compared to a surplus of $363 million recorded in March 2024.

📈 Nine-Month Current Account Flips to Surplus

With this latest jump, Pakistan’s current account for July–March FY25 (9MFY25) now stands at a surplus of $1.86 billion, a sharp contrast to the $1.65 billion deficit during the same period last year.

Brokerage firms Topline Securities and Arif Habib Limited have confirmed this is the highest monthly current account surplus ever recorded in Pakistan’s economic history.

💡 What’s Fueling This Historic Surplus?

Economic experts credit this impressive performance to a combination of positive macroeconomic factors, including:

✅ Record-breaking remittances

✅ Falling international oil prices

✅ Stable export growth

✅ Controlled import volumes

✅ Tight monetary policy and import restrictions

“With oil prices down and remittances hitting all-time highs, Pakistan’s current account is likely to remain in deep surplus through June FY25—possibly even into FY26,” said Khurram Schehzad, Advisor to the Finance Minister.

🔍 Key March 2025 Breakdown

Here’s a look at the detailed numbers from March 2025:

- Exports of goods & services: $3.51 billion

📈 Up 8.7% YoY from $3.23 billion in March 2024 - Imports of goods & services: $5.92 billion

📈 Up 8% YoY, reflecting moderate trade activity - Remittances: A record $4.05 billion

📈 Massive 71% jump compared to last year

SBP Governor also highlighted that total remittances in March alone hit $4.1 billion, reinforcing overseas Pakistanis’ strong role in stabilizing the country’s finances.

📊 What This Means for Pakistan’s Economy

This surplus brings multiple economic benefits for Pakistan, including:

💵 Reduced pressure on the rupee

📉 Lower risk of external financing gaps

📈 Improved investor sentiment and credit outlook

🏗️ Space for pro-growth economic policies in upcoming budget

🔮 Can This Momentum Continue?

Analysts are cautiously optimistic. If oil prices remain soft, remittance inflows stay high, and exports continue rising, Pakistan may end FY25 with a record surplus.

However, sustained improvement will require structural reforms, export diversification, and investment in local industries to maintain this momentum beyond FY25.

📢 For more updates on Pakistan’s economic breakthroughs, forex trends, and global market insights that impact you—stay connected with www.dailyforex.pk, your trusted financial news destination! 🇵🇰📊