NZD/USD Gains Momentum Ahead of Key Central Bank Decisions & Inflation Reports

The NZD/USD pair is showing signs of a momentum shift, trading near key support and resistance levels as traders navigate a week packed with high-impact economic events. Investors are closely watching central bank policies, inflation trends, and employment reports, which will likely dictate the next major move for the pair.

Technical indicators suggest a potential breakout, with stronger bullish momentum emerging after months of lower highs and lower lows. Meanwhile, the Reserve Bank of New Zealand (RBNZ) has hinted at a slower pace of rate cuts, adding an additional layer of complexity to the market.

With volatility expected to remain high, adaptability will be key for traders looking to capitalize on price fluctuations.

📢 Stay updated with real-time forex insights on DailyForex.pk

NZD/USD Technical Analysis – Key Levels to Watch

📊 Technical Indicators Suggest Strengthening Uptrend

✅ Momentum Oscillator remains above 100, indicating upside potential.

✅ RSI stays above 50, reinforcing sustained buying interest.

✅ Bullish reversal confirmed by a Hammer candlestick pattern at key support.

📈 Resistance Levels to Watch:

- 0.57489 – Daily high from February 17.

- 0.58230 – Weekly resistance (R2) based on Pivot Points.

- 0.58659 – Fibonacci 261.8% extension.

- 0.59277 – November 29 peak.

📉 Support Levels to Watch:

- 0.56858 – Weekly Pivot Point.

- 0.55994 – February 12 low.

- 0.55486 – Weekly support (S2).

- 0.55145 – February 3 daily low.

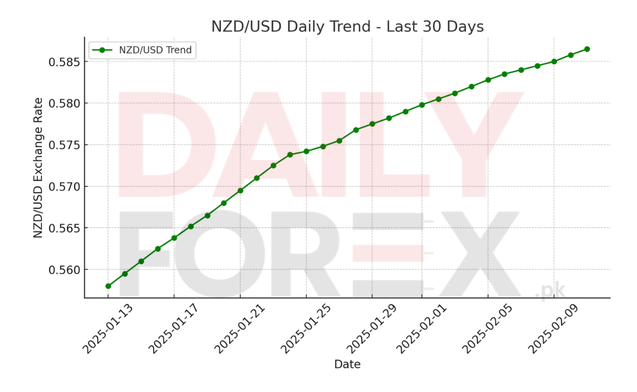

📊 Now, let’s analyze NZD/USD’s daily price trend. 📈

Fundamental Outlook – Key Market Drivers for NZD/USD

📌 RBNZ Adjusts Policy Amid Slower Rate Cuts

- New Zealand’s Reserve Bank (RBNZ) has slowed the pace of interest rate cuts, reducing the Official Cash Rate (OCR) to 3.75% after three consecutive 50-basis-point cuts.

- The RBNZ expects inflation to rise to 2.7% mid-year but remains confident it will stay within target.

- Economic recovery is anticipated in 2025, though global trade and geopolitical risks may impact growth.

📌 High-Impact Economic Events to Watch

- New Zealand Official Cash Rate (NZD) – Impact on RBNZ’s policy stance.

- UK CPI & Retail Sales (GBP) – May influence risk sentiment in forex markets.

- Australia Employment Change (AUD) – Could impact NZD via regional economic trends.

- US Unemployment Claims & PMI Data (USD) – Key indicators for USD movement.

📌 Global Sentiment & USD Impact

- A stronger USD could cap NZD/USD gains, while risk-on sentiment could boost demand for the Kiwi dollar.

📢 Follow real-time forex market updates on DailyForex.pk

Conclusion – What’s Next for NZD/USD?

With shifting monetary policy, key economic releases, and global uncertainties, NZD/USD is positioned for volatility. The RBNZ’s stance and upcoming data releases will be crucial in shaping short-term price action.

💡 Market Outlook:

✅ A breakout above 0.57489 could trigger further gains towards 0.58230 and 0.58659.

✅ If NZD/USD drops below 0.56858, support at 0.55994 and 0.55486 could be tested.

✅ Traders should monitor RBNZ guidance and broader economic trends.

📢 For daily forex forecasts, visit DailyForex.pk