Bollinger Bands are a powerful technical indicator used by forex traders to analyze market volatility, detect potential reversals, and spot trading opportunities in both trending and range-bound markets. In this guide, we break down how Bollinger Bands work, and how you can use them effectively to boost your trading performance.

What Are Bollinger Bands?

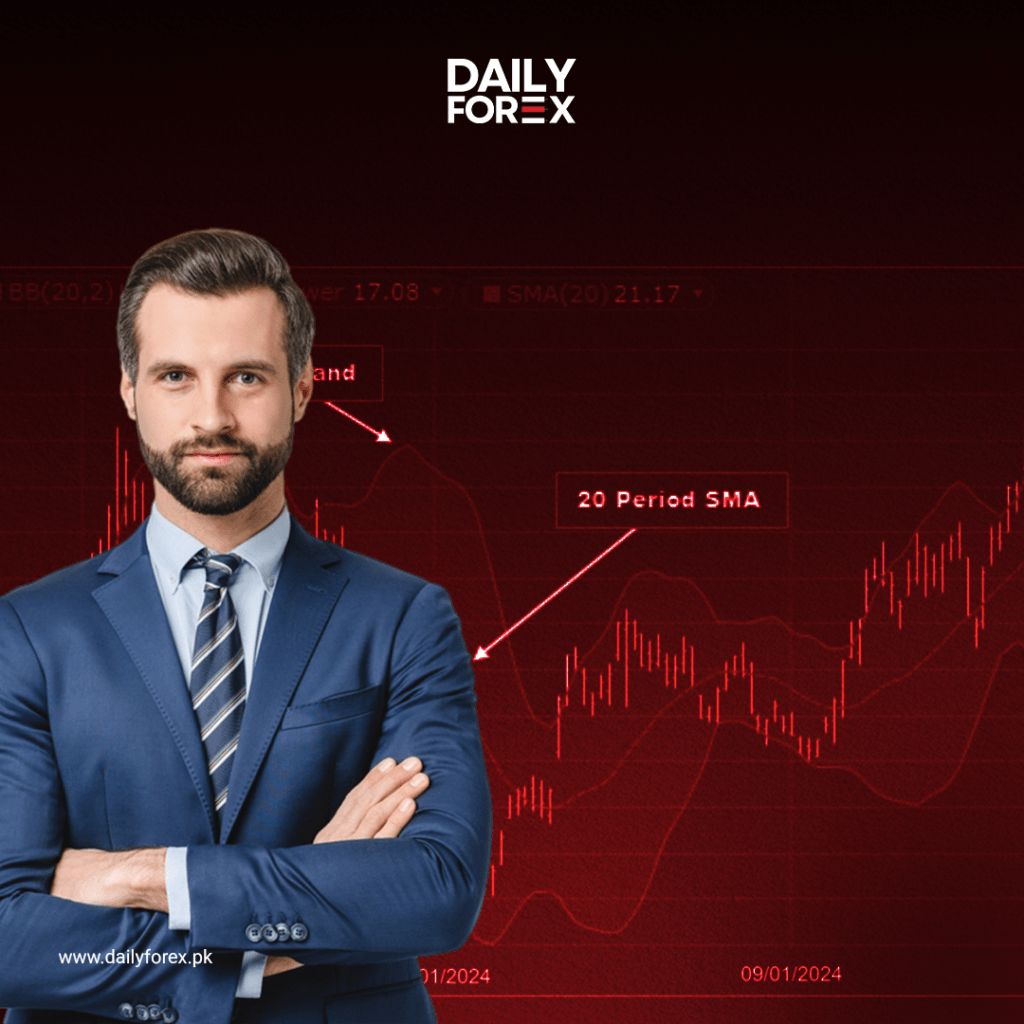

Developed by John Bollinger, Bollinger Bands consist of three lines:

- Middle Band: A simple moving average (SMA), typically set to 20 periods.

- Upper Band: Two standard deviations above the SMA.

- Lower Band: Two standard deviations below the SMA.

These bands expand and contract based on market volatility. When the market is volatile, the bands widen. When it’s calm, the bands tighten.

Understanding Bollinger Band Behavior

- Wider Bands = Higher volatility

- Tighter Bands = Lower volatility

This dynamic response to price action makes Bollinger Bands a valuable visual tool for tracking market behavior in real-time.

Strategy 1: The Bollinger Bounce

The Bollinger Bounce is based on the idea that price tends to return to the middle band after hitting the upper or lower band.

Best Used When: The market is ranging (not trending).

- Upper Band Touch: Look for price to bounce downward toward the middle band.

- Lower Band Touch: Look for price to bounce upward toward the middle band.

Tip: The longer the timeframe, the more reliable the bounce.

Strategy 2: The Bollinger Squeeze

The Bollinger Squeeze is a breakout strategy. It occurs when the bands contract tightly, indicating low volatility and a possible breakout.

How It Works:

- If price breaks above the upper band, it’s a bullish breakout signal.

- If price breaks below the lower band, it’s a bearish breakout signal.

This setup allows traders to catch big moves early, especially on 15-minute or hourly charts.

Practical Tips for Using Bollinger Bands

- Use Bollinger Bands with other indicators like support/resistance levels, trendlines, or candlestick patterns to improve accuracy.

- Avoid trading Bollinger Bounce setups during trending conditions.

- Look for Bollinger Squeeze opportunities in tight consolidation zones.

Final Thoughts

Bollinger Bands are a flexible tool that adapts to different market environments. Whether you’re a range trader or a breakout trader, this indicator offers valuable insights into price dynamics.

Experiment with different settings, observe price reactions, and refine your strategy. As always, practice with a demo account before going live.

Ready to explore more trading tools? Visit www.dailyforex.pk for more forex strategies, market updates, and expert insights.