Stock Market Surges as Tariff Delays Drive Risk Appetite

The global stock market rallied, with the S&P 500 nearing record highs as investors responded positively to President Trump’s tariff delays. The Dow Jones Industrial Average surged 342 points, driven by strong gains in tech stocks like Tesla, Nvidia, and Apple.

Meanwhile, the U.S. Dollar (USD) weakened against major currencies, reflecting market uncertainty over trade policy and Federal Reserve interest rate expectations. Treasury yields declined following hotter-than-expected inflation data, but investors focused on bullish momentum in equities instead.

📢 Stay updated with live market trends on DailyForex.pk

Stock Market Overview & Key Takeaways

📈 Stock Market Performance:

✅ S&P 500 nears all-time highs

✅ Dow Jones up 342 points

✅ Nasdaq 100 gains 1.4%, Russell 2000 up 1.2%

✅ Tech stocks lead the rally – Tesla, Nvidia, Apple rise over 3%

📉 Currency Market Reaction:

✅ USD weakens amid trade uncertainty

✅ JPY and CAD strengthen as safe-haven demand rises

✅ Market volatility eases – VIX falls to a three-week low

Despite the dollar’s decline, some analysts suggest that interest rate expectations and global monetary policies could keep long-term dollar strength intact. However, short-term uncertainty is weighing on the USD, creating opportunities in forex trading.

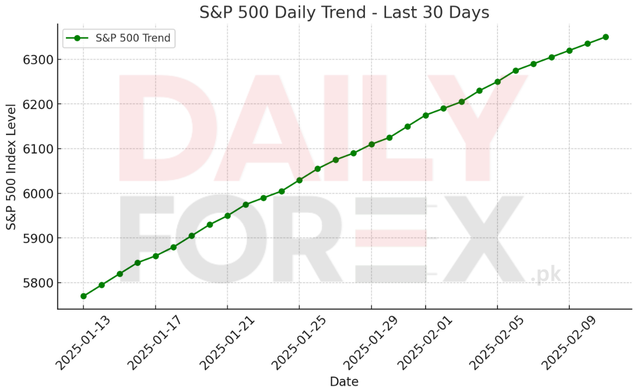

📊 Now, let’s analyze the daily S&P 500 market trend. 📈

S&P 500 Technical Analysis – Key Support & Resistance Levels

The S&P 500 index remains in an uptrend, with higher highs and higher lows confirming strong bullish sentiment.

📈 Key Resistance Levels:

- 6129.55 – First upside target.

- 6265.08 – Medium-term breakout level.

- 6484.39 – Long-term resistance.

📉 Key Support Levels:

- 5993.77 – First support zone.

- 5910.24 – Major support area.

With bullish momentum intact, traders will closely monitor Federal Reserve rate policy and tariff updates for potential market shifts.

What’s Next for the Stock Market & Forex?

💡 Key Market Drivers:

📌 Federal Reserve Policy: Interest rate decisions remain critical to market direction.

📌 Tariff Developments: Any new trade announcements could impact risk sentiment.

📌 Upcoming Economic Data: U.S. retail sales figures will influence the market’s next move.

While stocks continue to climb, trade policy uncertainty and inflation concerns could bring volatility. Traders should watch key resistance levels and potential shifts in Federal Reserve expectations.

📢 For daily financial market insights, visit https://dailyforex.pk/