The London session is the most critical forex trading session, responsible for the highest trading volume and liquidity. Whether you’re an experienced trader or just starting, understanding when and how to trade during the London session can significantly impact your trading success.

Why the London Session Matters in Forex Trading?

📍 Largest Trading Volume: Nearly 43% of global forex transactions happen in London.

📍 High Volatility: More price movement means greater profit opportunities.

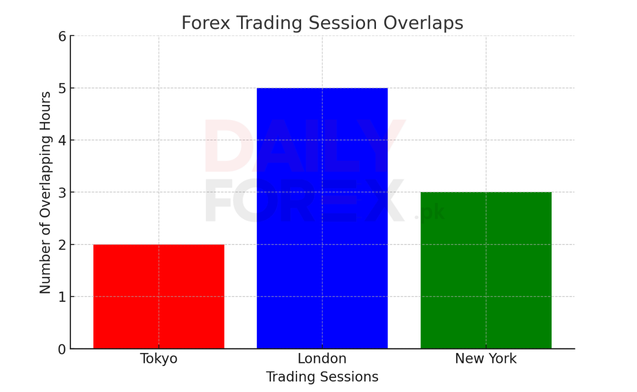

📍 Major Market Overlap: London overlaps with both the Asian and New York sessions, making it a crucial period for traders worldwide.

London Session Trading Hours

- GMT: 08:00 AM – 05:00 PM

- EST: 03:00 AM – 12:00 PM

- Local Time (UK): 08:00 AM – 05:00 PM

The London market’s opening hours overlap with the end of the Tokyo session and the start of the New York session, creating periods of high volatility.

Best Currency Pairs to Trade in the London Session

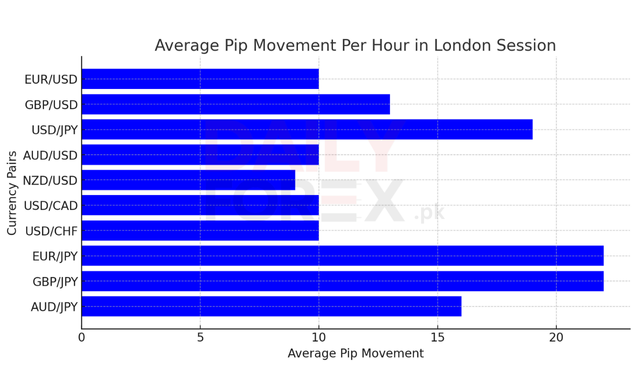

Thanks to the high liquidity and market-moving news events, almost all major currency pairs are actively traded. Here are the best forex pairs for this session:

| Currency Pair | London Session Pip Range |

|---|---|

| EUR/USD | 10 pips |

| GBP/USD | 13 pips |

| USD/JPY | 19 pips |

| AUD/USD | 10 pips |

| NZD/USD | 9 pips |

| USD/CAD | 10 pips |

| USD/CHF | 10 pips |

| EUR/JPY | 22 pips |

| GBP/JPY | 22 pips |

| AUD/JPY | 16 pips |

📌 Tip: The GBP/JPY and EUR/JPY pairs tend to be the most volatile during the London session.

Key Characteristics of the London Session

✅ High Liquidity & Lower Spreads: Large trading volume ensures tight spreads and efficient trade execution.

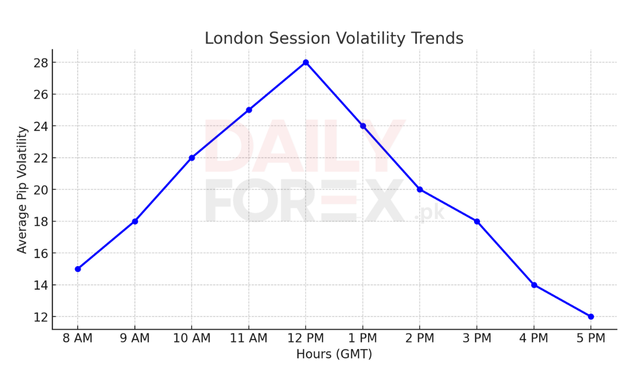

✅ High Volatility: Price movements are stronger than in the Asian session, creating more trading opportunities.

✅ Trends Begin Here: Many trends start during the London session and continue into the New York session.

✅ Market Reversals Possible: As traders take profits, markets may reverse before New York opens.

Best Trading Strategies for the London Session

💡 1. Breakout Trading Strategy

- The London session starts with high volatility.

- Look for breakouts from the Asian session’s range.

💡 2. Trend Following Strategy

- Identify strong trends forming early in the London session.

- Use moving averages or trendlines to follow the momentum.

💡 3. News Trading Strategy

- Economic reports from the UK, Eurozone, and major financial hubs cause strong market movements.

- Use a forex calendar to anticipate price spikes.

Should You Trade the London Session?

👉 If you prefer high volatility and strong trends, the London session is perfect for you.

👉 If you are a short-term scalper, this session offers tight spreads and quick price movements.

👉 If you don’t like market noise, consider trading later in the day when volatility slows down.

Final Thoughts: Maximizing Your Profits in the London Session

The London forex session is the most active, liquid, and volatile period in the forex market. Whether you’re a day trader, scalper, or swing trader, mastering this session will improve your chances of trading success.

📌 Stay updated with live forex market news and analysis at www.dailyforex.pk. 🚀💹