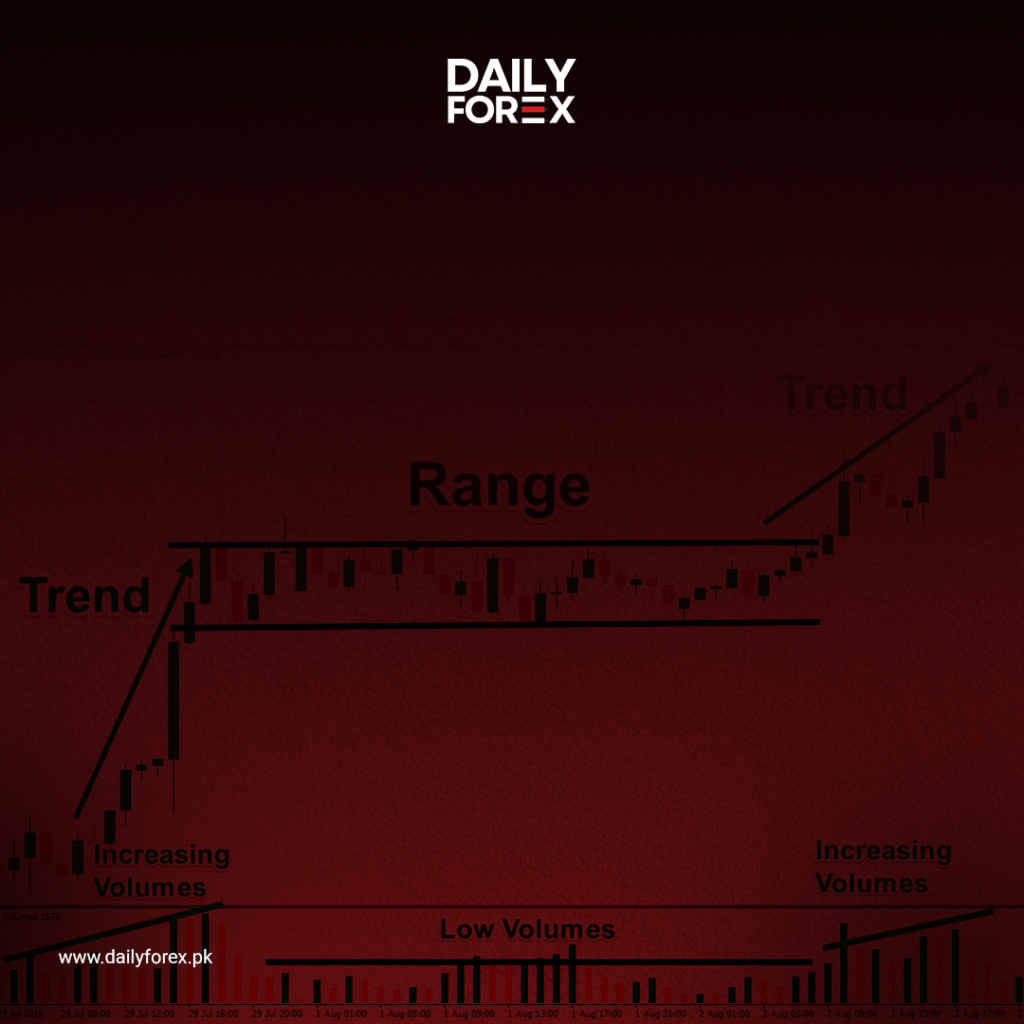

A range-bound market occurs when price moves between a clearly defined high and low, bouncing back and forth without breaking through either level. The upper boundary acts as strong resistance, while the lower boundary serves as significant support.

This type of market is also referred to as sideways, horizontal, or choppy, due to the lack of clear directional movement. Like waves in a calm sea, price simply fluctuates within a narrow band, frustrating trend traders who often get “chopped up” trying to find momentum where there is none.

Fun fact: In a choppy market, the favorite dish might as well be… chop suey!

How to Identify a Range-Bound Market

1. Using the ADX Indicator

As discussed earlier, the Average Directional Index (ADX) is a reliable tool for measuring trend strength. When the ADX value falls below 25, it usually signals a weak or non-existent trend — a classic condition for a range-bound market.

2. Using Bollinger Bands

Bollinger Bands adjust with market volatility. In a ranging market, the bands contract, reflecting low volatility and tight price movement. This compression is often a precursor to a breakout but also highlights a potential opportunity for range trading strategies.

Look for the bands to move horizontally and closely together—a sign that price is staying within a narrow channel.

How to Trade in a Range-Bound Market

The key idea behind range trading is to buy low and sell high within the range. When the price nears the support level, look for buying opportunities. When it approaches resistance, look for selling opportunities.

Recommended Tools:

- Bollinger Bands: For visualizing the range and identifying volatility shifts.

- Stochastic and RSI Oscillators: To spot overbought or oversold levels at range extremes.

- Trend Channels: Draw horizontal lines to mark the support and resistance boundaries of the range.

Example:

Take a look at GBP/USD: if price consistently bounces between two levels and the Stochastic oscillator confirms overbought/oversold conditions near the range edges, you could confidently trade within that range.

Best Currency Pairs for Range Trading

Currency cross pairs (those that don’t involve the USD) are often ideal for range trading due to their relatively stable nature.

- EUR/CHF: A popular range-trading pair due to the similar economic growth rates of the Eurozone and Switzerland.

- AUD/NZD: Often trades in predictable ranges thanks to the economic ties between Australia and New Zealand.

Final Thoughts

Whether you’re in a trending or range-bound environment, there are strategies that can help you capitalize on market conditions. The trick lies in being able to identify the environment and apply the right tools and tactics for each situation.

When you can recognize these conditions on your chart, you’ll be in a better position to pick tops, bottoms, and ultimately—opportunities.

Stay Educated with Daily Forex Pakistan.