Once you’re confident with classic chart patterns, it’s time to take your technical analysis to the next level. Welcome to the world of harmonic price patterns—a precise and powerful method to identify high-probability trade setups in the forex market.

Unlike traditional chart patterns, harmonic patterns are based on strict Fibonacci retracement and extension ratios. This makes them more objective and rule-based, offering traders a reliable structure to forecast market reversals and trend continuations.

📊 What Are Harmonic Price Patterns?

Harmonic patterns are geometric price formations based on Fibonacci ratios that help traders spot potential retracements and reversals in ongoing trends. These patterns work on the principle that price movements are cyclical and repeat over time.

While they may seem complex at first, harmonic patterns can be extremely rewarding once mastered. When identified correctly, they reveal high-probability areas for trend continuation or reversal, often before the broader market catches on.

🔍 How Do Harmonic Patterns Work?

These patterns are constructed using Fibonacci retracement and extension levels to define precise turning points in the market. Unlike classic patterns (like head and shoulders or double tops), harmonic patterns must follow strict ratio rules—this removes much of the subjectivity and guesswork.

Once a harmonic pattern completes, it signals a potential area where price may change direction, giving traders an edge in timing their entries and exits.

📚 The Most Common Harmonic Price Patterns

Here are the six most widely used harmonic price patterns in forex:

- ABCD Pattern – The simplest of all harmonic patterns, it helps traders identify basic price swings and retracements.

- Three-Drive Pattern – A more advanced formation made up of three symmetrical moves and retracements.

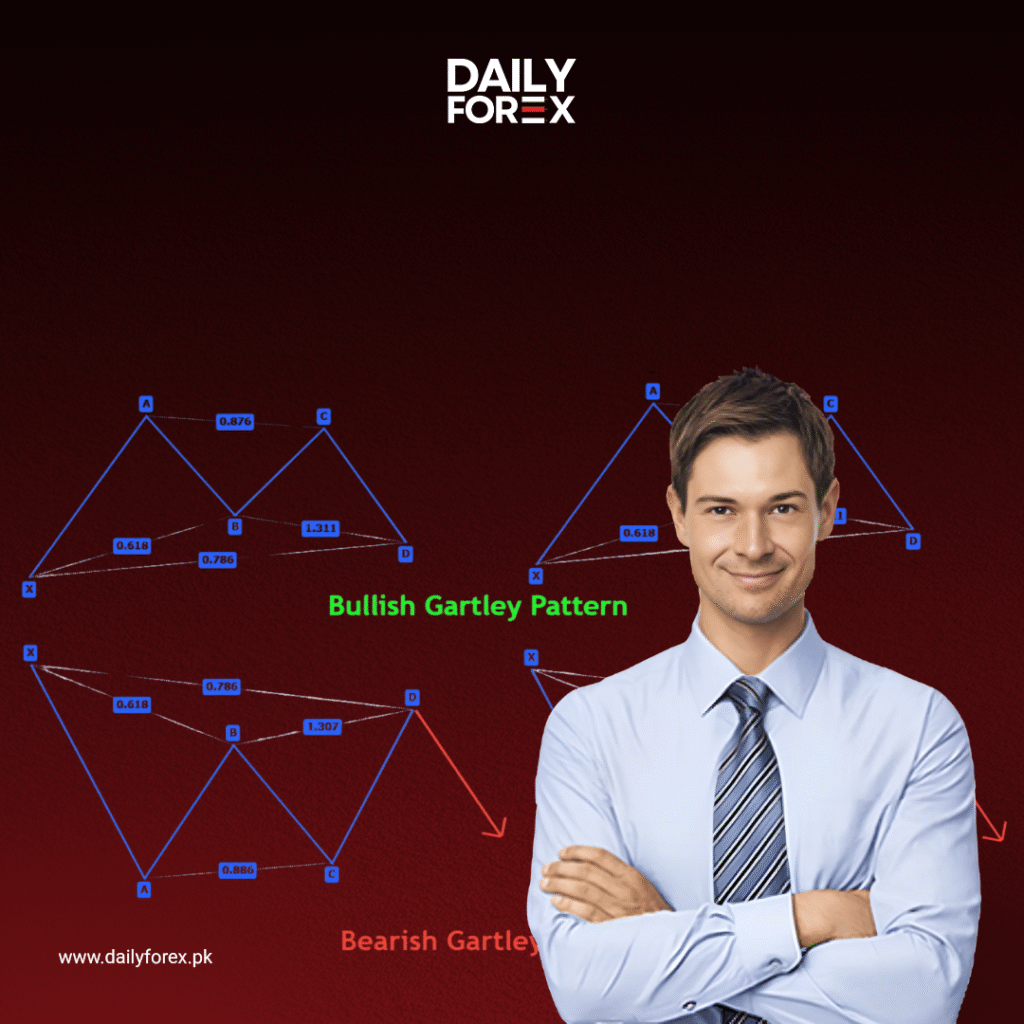

- Gartley Pattern – A powerful setup often signaling reversals at key Fibonacci levels.

- Crab Pattern – Known for identifying deep price extensions and sharp reversals.

- Bat Pattern – Offers excellent risk-reward setups due to its shallow retracement structure.

- Butterfly Pattern – Often marks the end of a trend and the start of a major correction.

We’ll explore each of these patterns in detail in the upcoming lessons, starting with the basics (ABCD and Three-Drive), then moving on to the more intricate animal-named formations.

🛠️ Why Harmonic Patterns Matter in Forex

- Based on objective Fibonacci rules – less guesswork

- Help predict reversals and continuation zones before they happen

- Work across all timeframes and currency pairs

- Combine perfectly with tools like Fibonacci retracement, trendlines, and support/resistance

⏳ When to Trade Harmonic Patterns

Patience is key. You should only act once the entire harmonic pattern is complete. Jumping in too early can lead to false signals. Wait for price action confirmation near the completion point before entering your trade.

📈 Ready to Level Up?

In the next chapters, we’ll break down each harmonic pattern with real-world forex examples and show you how to trade them step-by-step, including:

- Entry points

- Stop-loss placement

- Target levels

Stay Updated With Dailyforex.pk