Gold prices in Pakistan continued their upward momentum today, touching another record high as global prices rallied and the rupee faced mild pressure against the U.S. dollar. Local demand remains strong amid ongoing wedding season activity and inflation concerns.

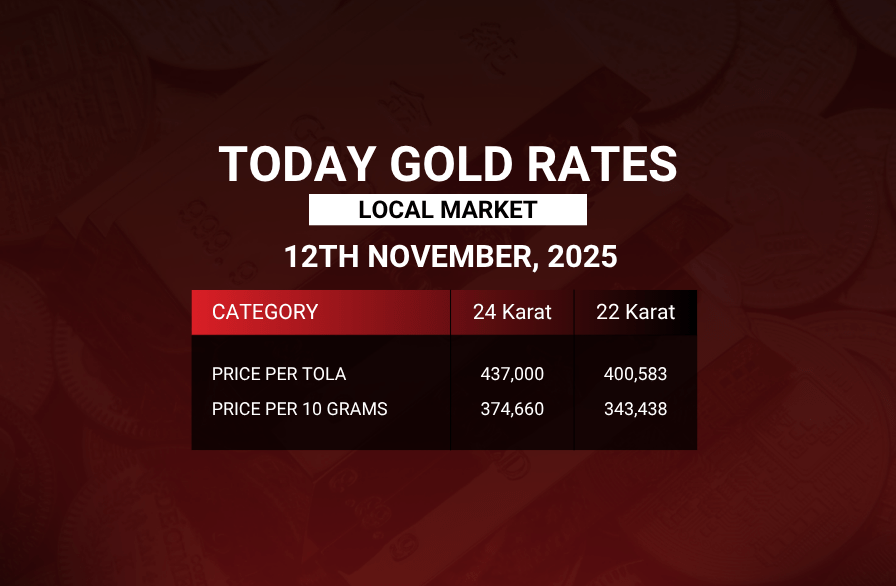

| Purity | Per Tola (11.67 g) | Per 10 Grams | Per Gram | Per Ounce |

|---|---|---|---|---|

| 24K Gold | PKR 437,000 | PKR 374,660 | PKR 37,466 | PKR 1,061,910 |

| 22K Gold | PKR 400,583 | PKR 343,438.33 | PKR 34,343.83 | PKR 973,417.5 |

| 21K Gold | PKR 382,375 | PKR 327,827.5 | PKR 32,782.75 | PKR 929,171.25 |

| 18K Gold | PKR 327,750 | PKR 280,995 | PKR 28,099.5 | PKR 796,432.5 |

💹 24K gold increased by PKR 6,000 per tola compared to the previous session — marking another all-time high amid strong global and domestic momentum.

🌍 Global Market Overview

- International gold prices surged to around $4,085 per ounce, supported by rising safe-haven demand and expectations that global central banks may pause or slow future rate hikes.

- A softer U.S. dollar and declining bond yields further boosted investor appetite for bullion.

- Analysts at Reuters report that persistent inflation and global growth concerns are continuing to drive capital flows toward precious metals.

- The ongoing geopolitical risks across key regions have also added to gold’s short-term strength.

🇵🇰 Domestic Market Insights

- The Pakistani Rupee slipped slightly to around PKR 283.50 per USD, adding further upward pressure to domestic gold prices.

- Retail demand remains strong nationwide, with major gold markets in Karachi, Lahore, and Islamabad reporting brisk trade, particularly for bridal jewellery and bullion investment pieces.

- Investors continue to view gold as a secure store of value amid economic uncertainty and persistent inflationary pressures.

- The price hike also reflects a reaction to global volatility, with local markets closely tracking international spot rates.

💡 Market Sentiment & Outlook

- Buyers: Prices are currently at record highs, so short-term buyers may want to wait for minor corrections. Long-term investors, however, continue to see gold as a stable hedge.

- Sellers/Investors: The rally provides an ideal profit-taking opportunity for traders who bought gold earlier this month.

- Analysts’ View: The near-term trend remains bullish, with potential resistance around PKR 440,000 per tola. Unless the rupee strengthens or global prices cool, the momentum is expected to continue.

🔍 Key Market Triggers

- USD/PKR exchange fluctuations — directly influencing local bullion prices.

- Upcoming U.S. inflation data — a major driver for global gold direction.

- Local festive demand — likely to sustain elevated prices through mid-November.

Stay informed with Daily Forex Pakistan for real-time gold price updates, forex insights, and international market trends.

🔗 www.dailyforex.pk