Gold prices continue their upward momentum, attracting active traders looking for short-term opportunities in Comes gold futures. With the 5-minute chart highlighting crucial support and resistance levels, traders can use this technical analysis to refine their intraday strategies.

📌 Key Trading Insights:

✔ Gold remains bullish but faces resistance at key price levels.

✔ Traders should look for buying opportunities on early strength.

✔ Selling pressure may increase if gold fails to break above resistance.

📈 Gold Price Key Levels for February 18

🔹 Resistance Levels (Sell Zones)

✔ $2,935.10 – Major intraday resistance; a breakout could trigger further gains.

✔ $2,940.00 – Psychological level; traders must watch for potential price rejection.

✔ $2,950.00 – Strong resistance; surpassing this may lead to new highs.

🔹 Support Levels (Buy Zones)

✔ $2,920.50 – First support zone; holding above this is key for bullish sentiment.

✔ $2,910.00 – Important level; breaking below this could accelerate selling.

✔ $2,900.00 – Critical support; a breach may signal trend reversal.

📊 Technical Outlook:

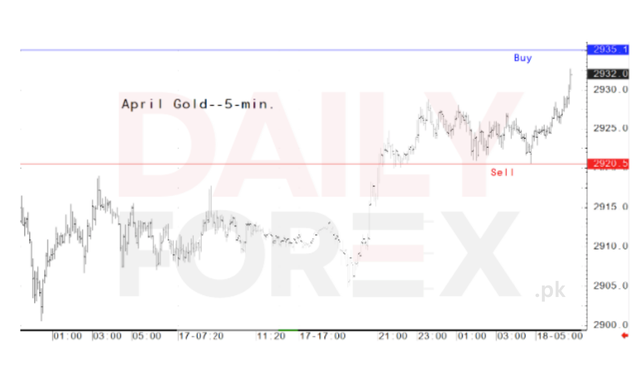

🔹 The 5-minute chart suggests a bullish trend, but volatility remains high.

🔹 A break above $2,935.10 could push gold toward new highs, while a drop below $2,920.50 may bring increased selling pressure.

📊 Gold Intraday Price Chart – February 18, 2025

📌 Image Source: DailyForex.pk – Your trusted source for forex and gold market analysis!

🔍 Trading Strategy for Intraday Traders

📢 BUY TRADE SETUP:

✔ Enter Long Near Support ($2,920.50) 🔼

✔ Target: $2,935.10 and $2,950.00 📈

✔ Stop-Loss: Below $2,910.00 ❌

📢 SELL TRADE SETUP:

✔ Enter Short Near Resistance ($2,935.10) 🔽

✔ Target: $2,920.50 and $2,910.00 📉

✔ Stop-Loss: Above $2,940.00 ❌

📌 Pro Tip: Always use proper risk management strategies, as gold prices can be highly volatile in intraday trading.

📢 What’s Next for Gold?

🔹 Gold’s uptrend remains intact as traders seek safe-haven assets.

🔹 Market participants will watch for U.S. economic data impacting the U.S. dollar and gold prices.

🔹 A break above $2,935.10 could lead to $2,950+, while failure to hold $2,920.50 may bring downside risk.

🚀 Get the latest gold price updates, forex insights, and expert trading strategies at:

👉 DailyForex.pk 🔥📊