Gold Market Analysis for February 10 – Key Intraday Price Levels for Active Traders

Gold prices are experiencing short-term volatility, creating opportunities for intraday traders. If you aim to capitalize on market fluctuations, it is crucial to monitor key technical support and resistance levels.

At DailyForex.pk, we provide real-time market analysis to help gold traders make informed decisions. Let’s explore the key buy and sell levels for February 10.

📉 Key Intraday Gold Market Levels

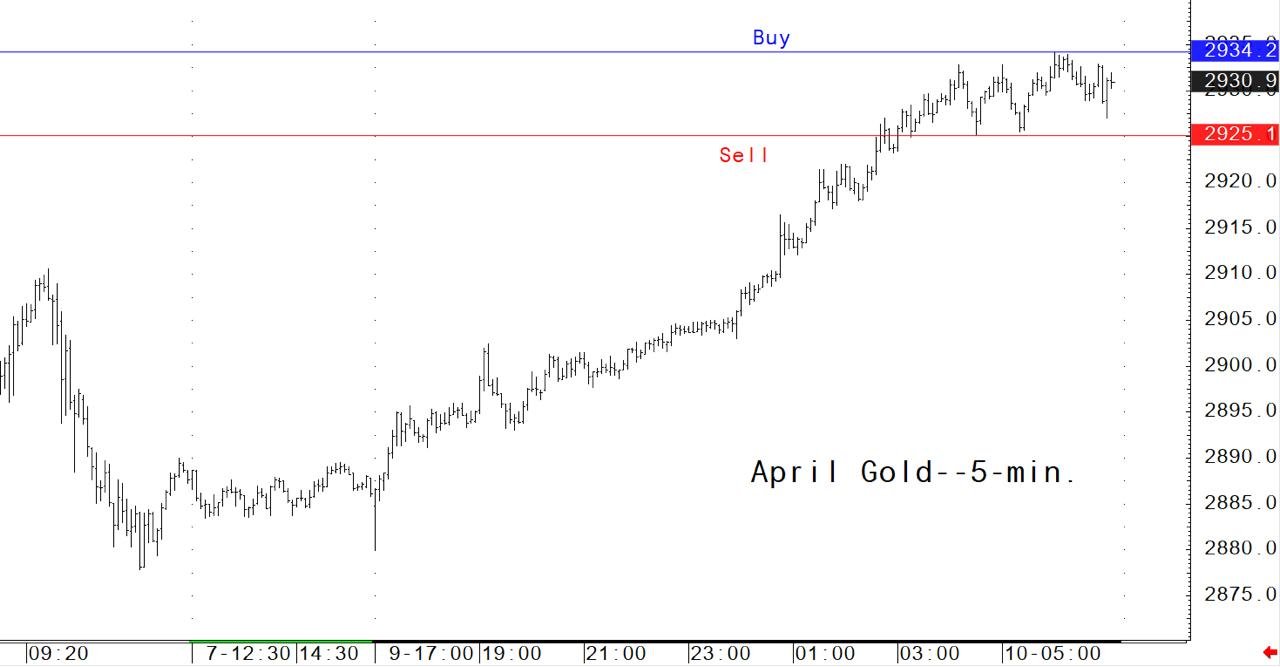

Using the 5-minute COMEX gold futures chart, we identify crucial price levels where significant market activity is expected. Traders should closely monitor these levels to take advantage of potential breakouts or pullbacks.

🔹 Key Resistance Levels (Selling Opportunities)

- $2,055 – $2,060 – Strong intraday resistance; failure to break above this level could present short-selling opportunities.

- $2,070 – A psychological barrier; rejection at this level may indicate further downside movement.

- $2,085+ – A breakout above this level could signal bullish momentum, potentially leading to higher price levels.

🔹 Key Support Levels (Buying Opportunities)

- $2,040 – $2,045 – Initial support zone; if the price holds, it could present a buying opportunity.

- $2,030 – A stronger support level; holding this level could sustain the bullish trend.

- $2,015 – $2,020 – Major support zone; if gold drops to this level, watch for a potential reversal pattern.

📌 Trading Tip: Successful traders typically buy on early strength and sell on early weakness to maximize profits.

📊 Gold Market Trends & Analysis

🔸 Short-Term Trend: Gold is in a sideways consolidation phase, and market data suggests a possible breakout or breakdown.

🔸 Key Market Drivers: U.S. inflation data, Federal Reserve policies, and geopolitical risks can significantly impact gold prices.

🔸 Technical Indicators: RSI and Moving Averages indicate mild bullish momentum, but key levels need to be monitored for confirmation.

💡 Benefits of Gold Trading with DailyForex.pk

🔹 Daily Expert Analysis – Get updates on intraday support and resistance levels.

🔹 Real-Time Price Updates – Access live gold market data for precise decision-making.

🔹 Pro Trading Insights – Identify optimal entry and exit points for profitable trades.

🚀 Enhance your forex and gold trading today! Visit: DailyForex.pk for expert market insights!