Elliott Wave Theory is a powerful form of technical analysis rooted in the idea that financial markets move in repetitive, predictable cycles influenced by collective investor psychology—primarily driven by fear and greed.

Who Created Elliott Wave Theory?

The theory was developed by Ralph Nelson Elliott, a professional accountant and brilliant mind of the early 20th century. In the 1920s and 1930s, Elliott analyzed more than 75 years of market data. Contrary to the belief that markets move chaotically, he discovered a consistent pattern in price movements.

At age 66, Elliott published his breakthrough in a book titled “The Wave Principle”, introducing the concept of waves that reflect recurring investor sentiment and behavior.

What Is the Elliott Wave Theory?

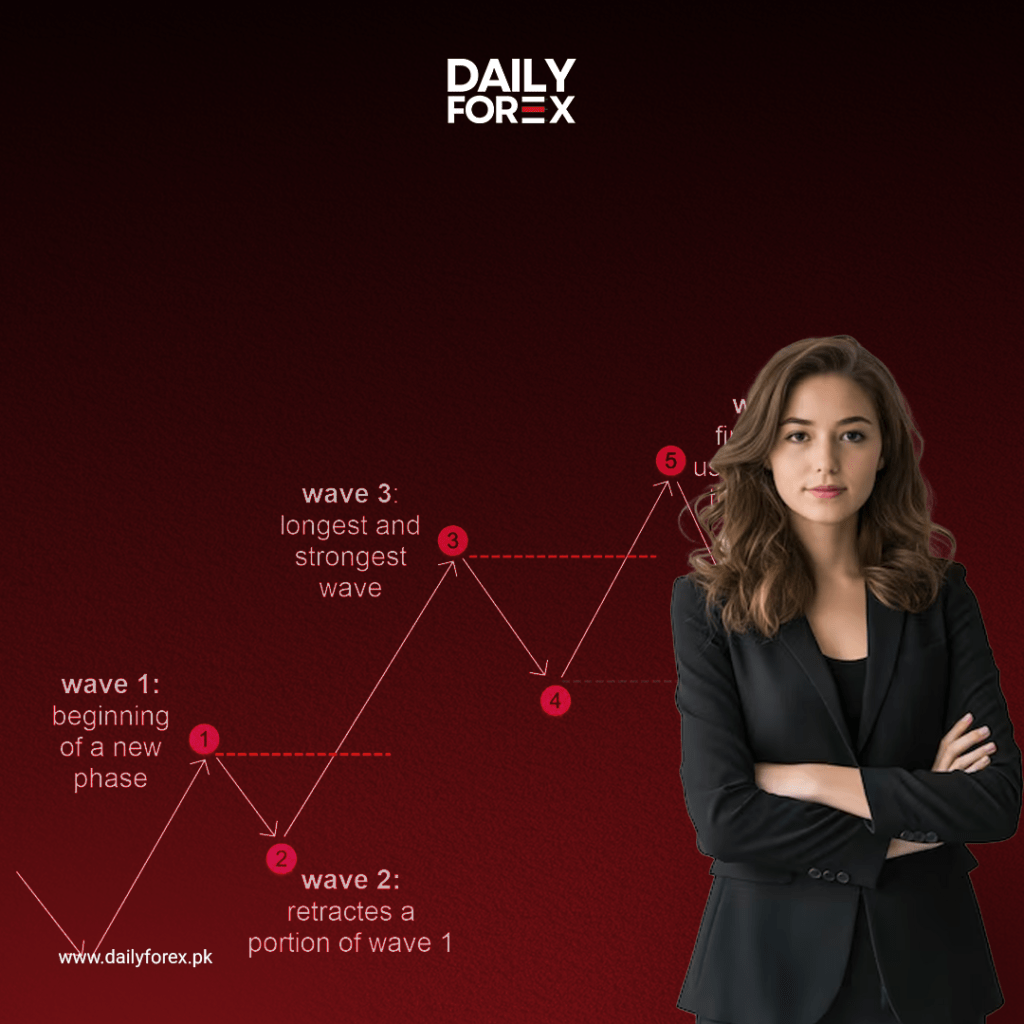

At its core, Elliott Wave Theory suggests that markets move in predictable wave patterns that mirror crowd psychology. These patterns consist of impulse waves (which move in the direction of the trend) and corrective waves (which move against it).

Elliott concluded that:

- Price movements are not random

- Market trends unfold in repetitive cycles

- These cycles are influenced by external news, sentiment, and mass psychology

By identifying these wave patterns, traders can anticipate potential market tops and bottoms, giving them an edge in forecasting future price action.

Why Elliott Waves Matter to Traders

The primary appeal of Elliott Wave Theory is its predictive power. Traders use the wave patterns to:

- Spot possible trend reversals

- Identify entry and exit points

- Understand the psychology behind market moves

This makes Elliott Wave Theory especially useful for swing traders and investors who want to better understand market structure.

Understanding Fractals in Elliott Wave Theory

What Are Fractals?

Fractals are patterns or structures that repeat on different scales. Each part of a fractal resembles the whole—a concept known in mathematics as self-similarity.

Fractals are not just theoretical—they occur in nature all around us:

- Snowflakes

- Clouds

- Lightning bolts

- Seashells

Fractals and Elliott Waves

Elliott Waves are fractal by nature.

This means each large Elliott wave pattern can be broken down into smaller waves, and those smaller waves can be broken down even further. This characteristic enables traders to analyze markets at multiple timeframes—from the macro (monthly charts) to the micro (minute charts).

This fractal quality supports the idea that markets behave similarly across different timeframes, reinforcing Elliott’s belief in patterned, psychological-driven price movements.

Final Thoughts

Elliott Wave Theory provides traders with a structured approach to understanding and forecasting market moves. By combining it with the concept of fractals, traders can analyze market behavior across various timeframes with improved clarity.

While it may take time to master, the ability to identify wave patterns, understand market sentiment, and anticipate price reversals can be a valuable addition to any trader’s strategy.

📈 Want to learn how to apply Elliott Waves in real trading scenarios? Stay tuned for the next chapter where we’ll break down impulse waves, corrective waves, and how to count them accurately.

Stay Updated With Dailyforex.pk