When you’re trading cryptocurrencies like Bitcoin (BTC) on a crypto exchange, you’ll often see two numbers associated with any coin or token: the bid price and the ask price. Understanding these prices is essential for making informed trading decisions.

What Do Bid and Ask Mean?

In any trading environment, transactions require two parties: a buyer and a seller. These two prices represent:

- Bid Price: The highest price a buyer is willing to pay for a cryptocurrency.

- Ask Price (or Offer Price): The lowest price a seller is willing to accept for a cryptocurrency.

The bid is essentially where buyers are saying, “I’ll buy it for this much.” The ask is where sellers are saying, “I’ll sell it for this much.”

How They Work Together

To execute a trade:

- If you’re buying, your order must match with a seller’s ask price.

- If you’re selling, your order must match with a buyer’s bid price.

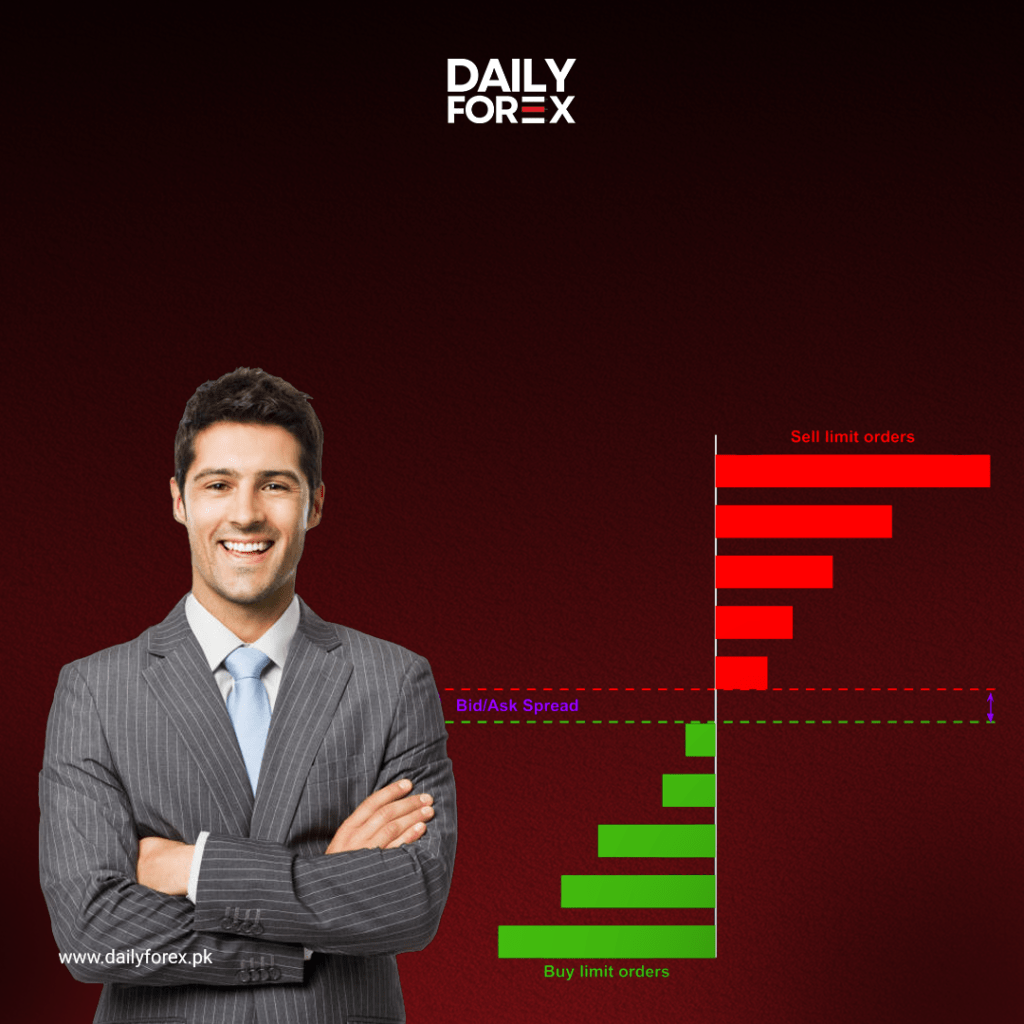

This interaction creates the bid-ask spread: the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

For example:

- Best Bid: $29,800 (highest buying price)

- Best Ask: $29,820 (lowest selling price)

- Spread: $20

This spread represents market liquidity and trading activity. A smaller spread usually indicates a more liquid market.

Market Orders vs. Limit Orders

Crypto exchanges let you place two main types of orders:

Market Order

- Executes immediately at the best available price.

- Buying: You get the best ask.

- Selling: You get the best bid.

Limit Order

- You set your preferred price and quantity.

- Buying: You place a bid (buy limit order).

- Selling: You place an ask (sell limit order).

These limit orders make up the order book, where the exchange matches buyers and sellers based on their specified prices.

How Crypto Exchanges Use Bid and Ask Prices

Exchanges compile all active buy and sell orders into a live order book, constantly updating the best bid and best ask prices. These prices determine the market price shown on trading screens.

When a bid and ask “cross” (i.e., when a buyer agrees to pay the seller’s price or vice versa), the exchange automatically executes the trade. This ensures fairness and efficiency in price discovery.

Final Thoughts

Understanding the bid and ask prices helps you:

- Get the best possible execution for your trades.

- Decide between placing a market or limit order.

- Gauge market activity and liquidity.

Whether you’re buying Bitcoin, Ethereum, or any other crypto, being aware of these basic pricing dynamics will help you trade more confidently on platforms like Binance, Coinbase, or any exchange in Pakistan or globally.

Stay tuned to www.dailyforex.pk for more beginner-friendly crypto guides and updates!