EUR/USD Holds Near Multi-Week High But Faces Resistance

The EUR/USD pair remains range-bound after registering four consecutive days of gains, hovering just below the key 1.0500 psychological mark during Monday’s Asian trading session. Despite a weakening U.S. Dollar (USD) driven by shifting risk sentiment, the euro (EUR) is struggling to break through resistance levels, with investors focusing on upcoming economic data and global trade tensions.

The pair’s movement remains influenced by trade policy developments, including Trump’s tariff plans and Germany’s stance on auto tariffs. Meanwhile, the U.S. retail sales report later today could inject fresh volatility into the market, with traders closely watching for signs of economic resilience or weakness in the U.S. economy.

📢 Stay updated with real-time forex insights on DailyForex.pk

EUR/USD Technical Analysis – Key Support & Resistance Levels

RSI and Moving Averages Signal Consolidation

📊 Technical Indicators:

✅ Relative Strength Index (RSI) above 70 – Suggests potential for a short-term correction before a continued uptrend.

✅ Price Action Stuck Below 1.0500 – Bulls need a strong breakout to extend gains.

✅ Key Support Levels Holding – Fibonacci retracement levels provide downside protection.

📈 Resistance Levels to Watch:

- 1.0500 – 1.0510: Key resistance zone (Fibonacci 78.6% retracement of the latest downtrend).

- 1.0550: Static resistance level.

- 1.0600: Beginning of the last downtrend.

📉 Support Levels to Watch:

- 1.0440: First support zone (100-period Simple Moving Average & Fibonacci 61.8% retracement).

- 1.0400: Strong Fibonacci 50% retracement level.

- 1.0350 – 1.0360: Critical support region (Fibonacci 38.2% retracement & 200-period SMA).

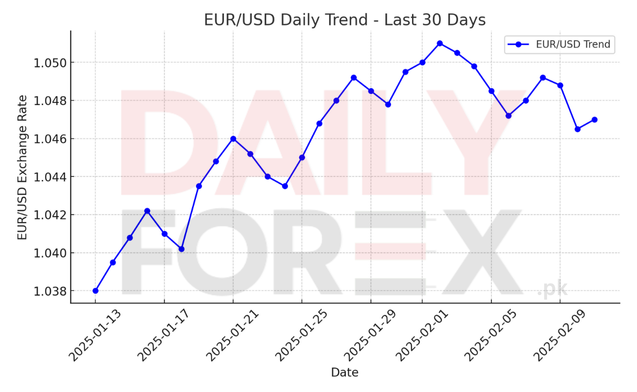

📊 Now, let’s analyze the daily EUR/USD price trend. 📈

Fundamental Overview – Key Market Drivers for EUR/USD

📌 Trade Developments & U.S. Dollar Weakness

- President Trump hinted at reciprocal tariffs, initially causing a drop in EUR/USD.

- Later, Trump refrained from imposing immediate tariffs, easing market concerns and allowing the euro to gain traction.

- Trump’s trade adviser, Peter Navarro, criticized German auto tariffs, adding pressure on U.S.-EU trade relations.

📌 Economic Calendar Highlights – What to Watch?

- EUR Trade Balance Data: Market expectations at €12.9B; any deviation could impact the euro’s strength.

- U.S. Retail Sales Data (Expected: -0.1%): A positive surprise may strengthen the USD, limiting EUR/USD upside potential.

- Germany’s Buba Monthly Report & ECB Comments: Traders will look for clues on future ECB monetary policy shifts.

📢 Get real-time forex market insights at DailyForex.pk

Conclusion – What’s Next for EUR/USD?

The EUR/USD remains range-bound, consolidating near multi-week highs but struggling to break the 1.0500 resistance zone. With economic data releases and trade policy shifts influencing sentiment, the pair’s movement could see heightened volatility in the near term.

💡 Market Outlook:

✅ If EUR/USD clears 1.0500, further gains toward 1.0550 and 1.0600 could be expected.

✅ Downside risks remain if U.S. economic data surprises positively, pushing EUR/USD back to 1.0440 or 1.0400 support zones.

✅ Federal Reserve signals and trade policies will be critical catalysts for directional movement.

📢 For daily forex forecasts, visit DailyForex.pk