Gold prices in Pakistan continued their upward momentum today, touching new highs amid strong international performance and persistent local demand. The precious metal remains one of the most stable investment assets in the current global climate.

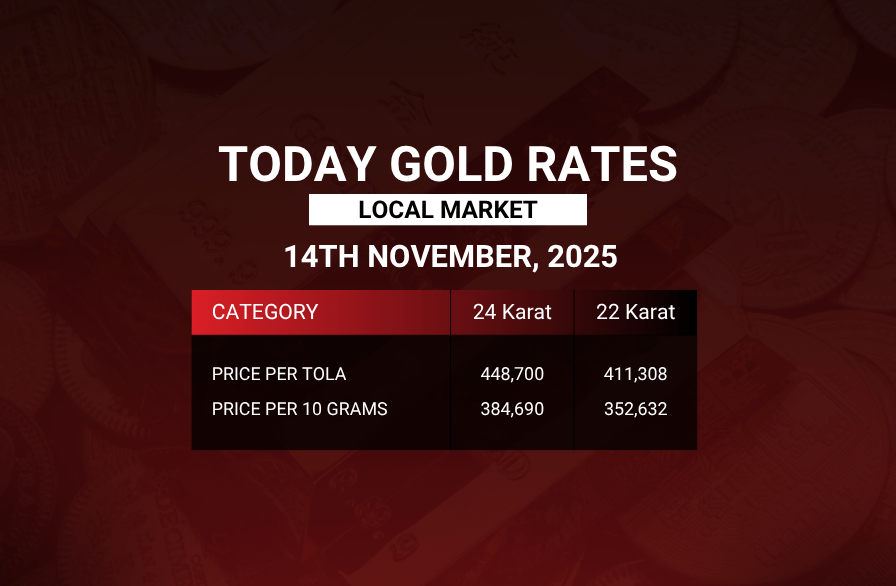

| Purity | Per Tola (11.67 g) | Per 10 Grams | Per Gram | Per Ounce |

|---|---|---|---|---|

| 24K Gold | PKR 448,700 | PKR 384,690 | PKR 38,469 | PKR 1,090,341 |

| 22K Gold | PKR 411,308 | PKR 352,632.5 | PKR 35,263 | PKR 999,479 |

| 21K Gold | PKR 392,613 | PKR 336,603.75 | PKR 33,660 | PKR 954,048 |

| 18K Gold | PKR 336,525 | PKR 288,517.5 | PKR 28,852 | PKR 817,755 |

💹 24K gold gained approximately PKR 12,900 per tola compared to last week, highlighting the ongoing strength in global and domestic gold markets.

🌍 Global Market Overview

- International gold prices surged above $4,200 per ounce, hitting their strongest levels in several weeks.

- The rally is fueled by expectations that global interest rates may begin to ease, along with a weaker U.S. dollar and continued inflation concerns.

- Analysts from Reuters report that the global bullion market is seeing higher inflows as investors shift toward safer assets amid geopolitical and economic uncertainty.

- Central banks continue to expand their gold reserves, lending further long-term support to bullion prices worldwide.

🇵🇰 Domestic Market Insights

- The Pakistani Rupee remained around PKR 283.45 per USD, maintaining mild pressure on import prices.

- Local demand remains steady due to wedding season activity and retail jewellery purchases.

- Market insiders report that despite record-high prices, investors are holding onto gold as an inflation hedge and a secure store of value.

- Dealers across Karachi, Lahore, and Islamabad note moderate trading volume, with premiums staying firm because of limited supply and import challenges.

💡 Market Sentiment & Outlook

- Buyers: Prices remain elevated, but dips—if they appear—are likely to be brief. Long-term investors continue to see gold as a defensive asset against inflation.

- Sellers/Investors: The surge offers profitable opportunities for partial liquidation, especially for gold acquired in earlier weeks below PKR 430,000 per tola.

- Analysts’ View: The trend remains strongly bullish, with resistance near PKR 452,000 and support around PKR 440,000 per tola. Sustained demand and rupee weakness could drive another leg up next week.

🔍 Key Factors to Watch

- USD/PKR exchange rate – directly impacts import and retail pricing.

- U.S. inflation data – critical for short-term global gold movement.

- Local jewellery demand – expected to remain firm through late November.

Stay informed with Daily Forex Pakistan for verified daily gold price updates, forex news, and international market insights.

🔗 www.dailyforex.pk