Regular divergence is a key technical analysis signal used to anticipate potential trend reversals in the forex market. It occurs when the movement of price and momentum indicators begin to disagree — often signaling that the current trend is weakening.

There are two main types of regular divergence:

- ✅ Regular Bullish Divergence

- ✅ Regular Bearish Divergence

✅ Regular Bullish Divergence

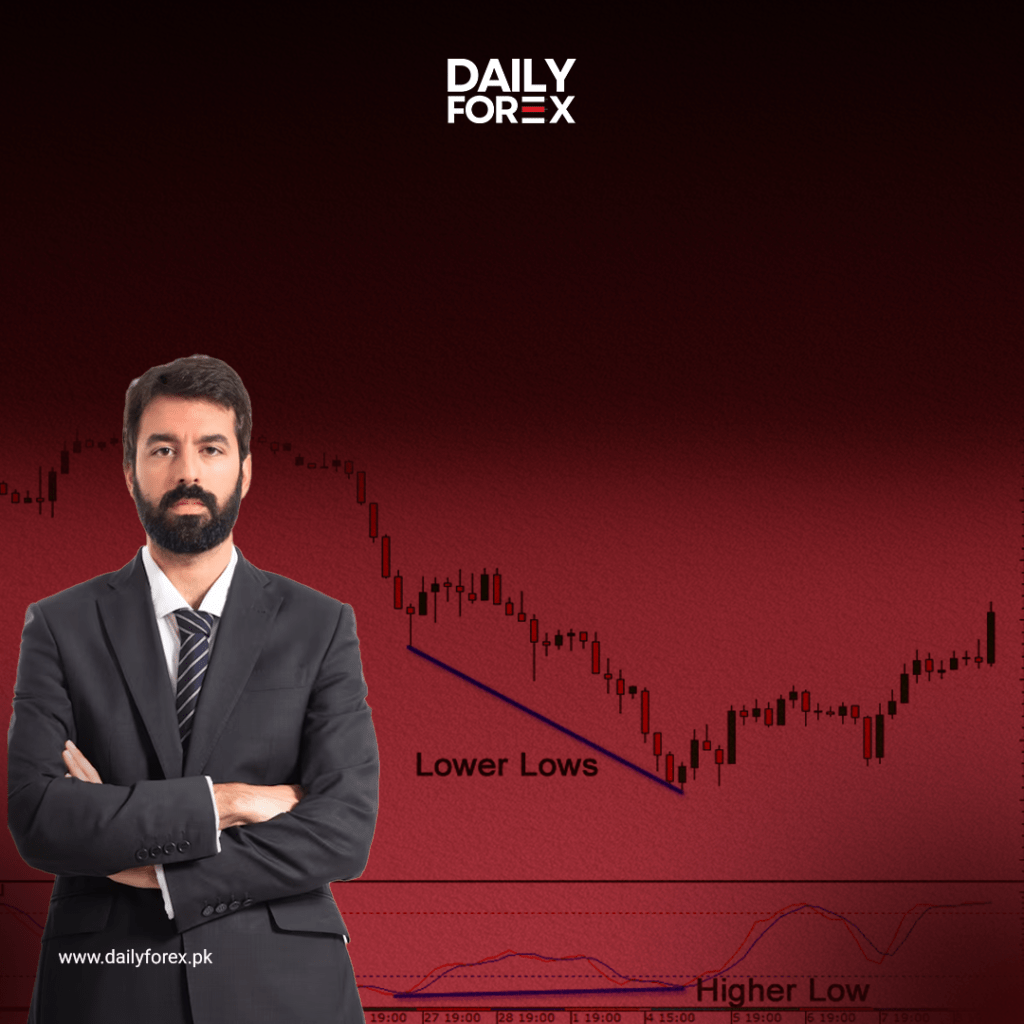

A regular bullish divergence appears when:

- Price forms lower lows (LL)

- But the oscillator forms higher lows (HL)

This setup typically occurs at the end of a downtrend and suggests a possible bullish reversal.

The reason? Momentum (represented by the oscillator) is no longer supporting the bearish price move. If the oscillator fails to confirm a new low while the price does, it signals a weakening downtrend — and a likely price rebound.

📉 Signal: Watch for the price to stop declining and start rising.

✅ Regular Bearish Divergence

A regular bearish divergence occurs when:

- Price forms higher highs (HH)

- But the oscillator forms lower highs (LH)

This typically happens during an uptrend and indicates that the bullish move may be losing strength.

If the price makes a new high, but the oscillator doesn’t confirm with a higher high, it may signal a potential trend reversal to the downside.

📈 Signal: Expect the price to drop after forming the second peak.

🔍 How to Use Regular Divergence

Regular divergence is best used when trying to identify market tops and bottoms. It acts as a warning that momentum is shifting, and the current trend may not be sustained much longer.

By paying attention to divergence between price action and indicators like:

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Stochastic Oscillator

…you can improve your chances of entering or exiting trades at optimal points.

What’s Next?

Now that you’ve learned about regular divergence, it’s time to uncover its lesser-known cousin: hidden divergence.

Don’t worry — it’s not buried deep like some market mystery. It’s simply hidden within the current trend and signals trend continuation rather than reversal.

➡️ Let’s dive into hidden divergence next.

Stay Educated with Daily Forex Pakistan.