Elliott Wave Theory is a powerful technical analysis tool that reveals how market prices move in predictable patterns due to crowd psychology. Here’s a quick summary of the key points:

🌊 Elliott Waves Are Fractals

- Each wave consists of smaller waves, showing self-similarity — a core property of fractals.

- This pattern repeats across all timeframes, from minutes to centuries.

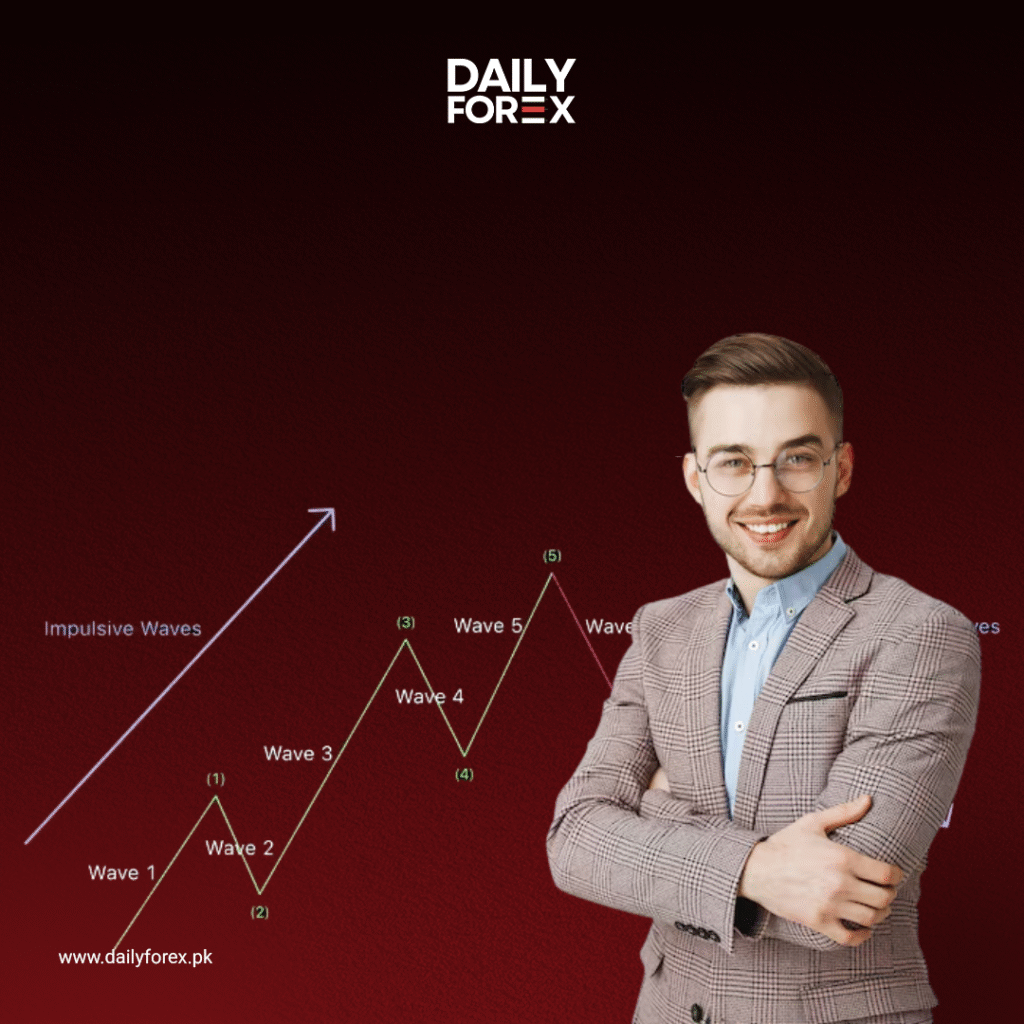

📈 The 5-3 Wave Structure

Markets move in a 5-wave impulse followed by a 3-wave correction:

- Impulse Waves (1, 3, 5) follow the trend.

- Corrective Waves (2, 4) move against the trend.

- Corrective patterns are labeled as A-B-C.

- Among the impulse waves, Wave 3 is usually the strongest and most extended.

🔁 Internal Wave Structure

- Impulse Waves (1, 3, 5) contain smaller 5-wave patterns.

- Corrective Waves (2 and 4) consist of smaller 3-wave patterns.

🔺 3 Basic Corrective Patterns

Although Elliott identified 21 variations, they all fall under these main categories:

- Zig-Zag – Steep corrections with clear A-B-C moves.

- Flat – Sideways corrections with roughly equal wave lengths.

- Triangle – Converging or diverging corrective structures.

📏 The 3 Cardinal Rules

When labeling Elliott Waves, always follow these strict rules:

- Wave 3 can NEVER be the shortest impulse wave.

- Wave 2 can NEVER retrace past the start of Wave 1.

- Wave 4 can NEVER enter the price territory of Wave 1.

🧠 Final Tip: Practice Makes Perfect

The forex market rarely moves in perfect wave formations. Reading and labeling Elliott Waves accurately takes consistent practice and time.

Stay Educated with Daily Forex Pakistan.