Many novice traders underestimate the signals given by Japanese candlesticks or large patterns on price charts. Notably, these signals are crucial for understanding market psychology and its current condition. Thus, it is nearly impossible to trade profitably without these tools.

This article reviews a very rare yet significant technical analysis pattern known as a “Gravestone doji” candlestick. The overview explains how effective a “Gravestone doji” pattern is in trading and provides guidance on how to properly integrate the pattern into your trading strategy.

The article covers the following subjects:

- Key Takeaways

- What Is a Gravestone Doji Candlestick?

- What Does a Gravestone Doji Look Like?

- How Does a Gravestone Doji Form?

- How to Identify the Gravestone Doji Candle Pattern

- How to Trade the Gravestone Doji Candlestick Pattern

- Gravestone Doji vs. Dragonfly Doji

- The Gravestone Doji Pattern – Pros and Cons

- Conclusion

- Gravestone Doji Pattern FAQs

Key Takeaways

| Main thesis | Conclusions and highlights |

| What is a “Gravestone doji” | A “Gravestone doji” is a pattern of candlestick analysis that forms at the top of an uptrend and warns market participants of a bearish trend reversal. Sometimes, this pattern emerges at the bottom of a downtrend, signaling a bullish reversal. |

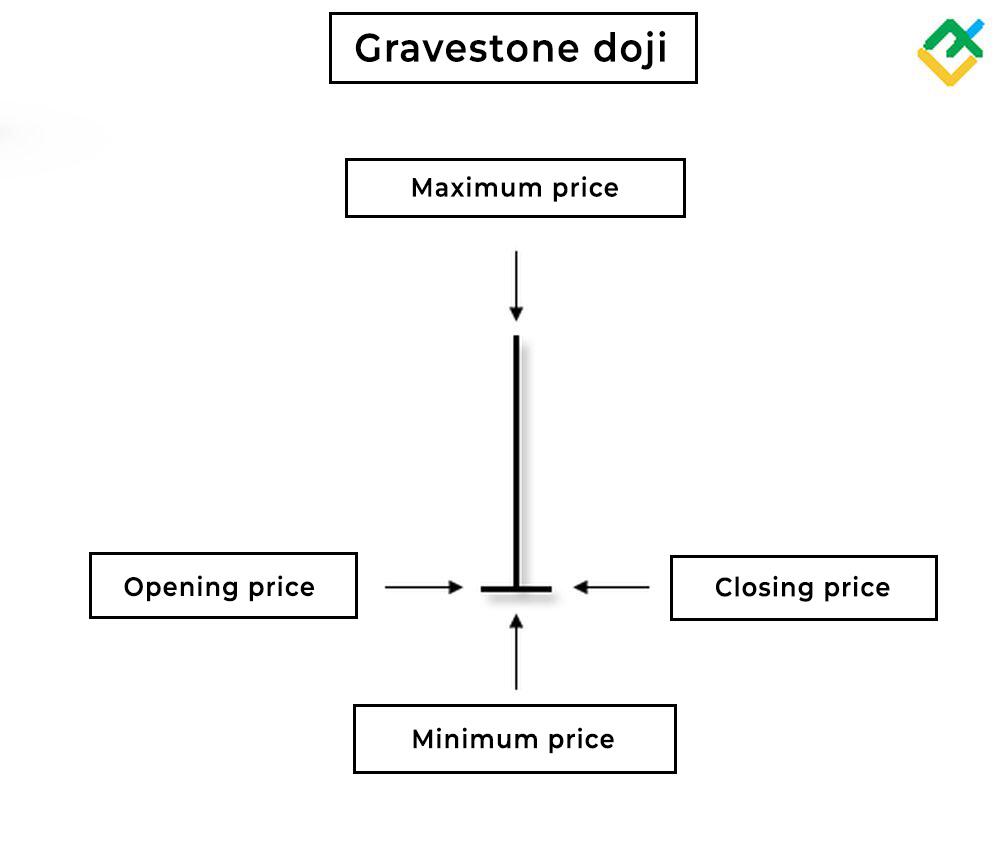

| How to spot a “Gravestone doji” pattern on a price chart | A “Gravestone doji” pattern comprises a single candlestick with no body and has only an upper shadow. The opening and closing prices are equal to candlestick’s low. |

| “Gravestone doji” pattern features | Rarely observed on price charts, a “Gravestone doji” candlestick closely resembles a “Shooting star” pattern but gives a stronger bearish signal. In technical analysis, the pattern is associated with military themes, evoking the image of a gravestone in memory of the fallen bulls and bears who defended their positions. |

| Why the pattern emerges on the chart | The market opens at swing lows, and the price grows to swing highs during the trading session. However, at a critical moment, the price suddenly reverses and closes at the swing low and opening price level. This shift in market sentiment can be facilitated by negative news or fundamental factors raising concerns among traders holding long positions. |

| Pattern’s influence on the market | A “Gravestone doji” pattern alerts the market about upcoming changes and a price reversal. The longer the pattern’s upper shadow, the higher the probability of a reversal. |

| Pattern’s pros and cons | A “Gravestone doji” candlestick pattern is easy to identify on a price chart. Its formation clearly defines support and resistance levels, allowing traders to determine potential pivot points in advance.However, a “Gravestone doji” formation, even with a long upper shadow, does not guarantee an immediate price reversal. Similar to other candlestick patterns, a “Gravestone doji” needs additional confirmation from technical indicators and other chart and candlestick patterns. |

| How to trade a “Gravestone doji” pattern | Before trading a “Gravestone doji,” it is important to pinpoint the key support and resistance levels. It is crucial to ensure the pattern has formed at these levels and wait for a confirmation. Once a “Gravestone doji” pattern is confirmed, you can open a trade in the direction of the reversal. |

| On what time frames can the pattern be observed | A “Gravestone doji” occurs on various time frames, but it is quite rare. Most often, the pattern can be found on H4 and lower time frames. On higher time frames, this pattern is even more uncommon. |

| A “Gravestone doji” pattern trading strategies | The pattern can be applied to both short-term and long-term trading strategies.When trading a “Gravestone doji” pattern intraday, you should open and close trades before the end of the trading session.Swing trading involves holding trades open for several days or weeks.For long-term trading, consider using W1 or higher time frames and open trades for a longer period, from several weeks to months, once the pattern appears.The efficiency of “Gravestone doji” trading increases with the use of additional technical indicators and other chart patterns. |

| Stop-loss levels | When trading a “Gravestone doji” candlestick pattern, a stop-loss order should be placed above or below the candlestick, depending on the prevailing trend. If the pattern forms at the peak of an uptrend, a stop-loss order is set above the dodgy candlestick and the resistance level. Conversely, if the pattern appears near the support line, a stop-loss order should be placed below the candlestick and the support level. |

What Is a Gravestone Doji Candlestick?

A “Gravestone doji” is a chart pattern that usually forms at the peak of an uptrend and consists of a single candlestick with a missing body and a long upper shadow.

The pattern takes the form of an inverted “T” due to the peculiarities of trading within a specific period. For example, on the daily time frame, the opening price is equal to the lowest price for the whole trading period. Next, throughout the day, the quotes grow to the highest level, and by the end of the trading session, they fall back to the opening and the lowest price level. A long wick reflects the impulse bearish pressure on the price.

A “Gravestone doji” pattern usually signals a fading bullish momentum and appears before a price reversal at the peak of an uptrend. However, this Japanese candlestick can also be observed at the bottom of a downtrend, signaling market uncertainty and indecision and a potential bullish reversal.

A “Gravestone doji” candlestick not only signals trend reversals but also suggests downward corrections following a prolonged bullish trend. Thus, it is better to look for the pattern at the trend’s highs.

An example of this pattern is illustrated below in the 30-minute stock chart of Walgreens Boots Alliance Inc.

The asset price was in the accumulation phase, but after the formation of a series of “Gravestone doji” patterns, it began to drop sharply. The patterns became a strong signal to close long trades and initiate short positions on the instrument.

What Does a Gravestone Doji Look Like?

A “Gravestone doji” bearish reversal pattern looks like an inverted letter “T” and resembles a tombstone from which it derives its name.

The opening and closing candlestick prices should be at the same level as its low. Sometimes, the pattern can form a small lower shadow, which is also considered a variation of a “Gravestone doji” pattern. Additionally, the upper shadow of the candlestick with the highest price should be long.

The pattern demonstrates how sales put pressure on bulls during the day, resulting in a significant decrease in quotes by the end of a trading session.

How Does a Gravestone Doji Form?

A “Gravestone doji” appears after a prolonged bullish trend. Initially, the market opens with price growth, but as a trading session progresses, the sales volume seriously increases, leading to a long upper shadow and a missing body formation. Essentially, a “Gravestone” candlestick is a reflection of the struggle between bulls and bears, with the latter emerging victorious.

The candlestick’s extended upper shadow indicates the bulls’ unstable position in the market. The pattern causes the closing of long positions and forces traders to open short ones, resulting in a market reversal and a subsequent price decline.

A vivid example of a sharp and impulsive price collapse after a “Gravestone doji” formation can be seen below on the 4-hour gold chart.

After a long upward trend, the asset hit strong resistance and retreated, forming “Bearish marubozu” candlestick patterns. Prior to the quotes’ sharp collapse, “Gravestone doji” and “Bearish engulfing” reversal patterns can be identified on the candlestick chart. The support breakout became a confirmation of the bearish trend’s beginning.

How to Identify the Gravestone Doji Candle Pattern

“Gravestone doji” candlestick patterns are easy to spot on a chart because of their unusual appearance. It is typically found at market peaks when an asset is undergoing a reversal following a prolonged uptrend. The presence of a long shadow and the absence of a candlestick body, with opening and closing prices at the same level as the low, indicate significant bearish pressure on the price.

Besides, make sure that the pattern forms at one of the key resistance levels. This confirms that bears become stronger.

Various stochastic and trend indicators, as well as volume and cash flow indicators, can be used to confirm a “Gravestone doji” candlestick. Moreover, additional candlestick and chart patterns, along with breakouts of support levels and trend lines, can be utilized to validate the pattern.

The hourly chart of the EURUSD currency pair shows how the price failed to break through the resistance level before a “Gravestone doji” pattern emerged. The pattern formation led to the downward trend reversal, and the subsequent appearance of a “Hanging man” reversal pattern finally confirmed the loss of the bullish momentum.

How to Trade the Gravestone Doji Candlestick Pattern

A “Gravestone doji” pattern forms at uptrends’ peaks, but as mentioned above, it can also be spotted at the bottom. Therefore, there are two strategies for trading a “Gravestone doji” in a bullish and bearish trend.

Bullish Gravestone Doji Candlestick Pattern

A bullish “Gravestone doji” variation is a less reliable upward reversal signal, unlike its bearish analog emerging at the top of an uptrend.

A bullish “Gravestone doji” pattern appears at the bottom after a prolonged bearish trend, signaling a waning of bearish momentum and a potential upward price reversal.