Gold Futures Markets

There are different ways to make money on gold trading assets. Physical metal is most often used for long-term investment, gold futures contracts are suitable for short-term investing.

- Please note that gold futures are exchange-traded securities, which is a contract between a buyer and a seller. This is a contract to a long or short position on yellow metal in the future at the current price which can be different from gold spot price. Gold futures contracts can be delivered and settled. Deliverable futures assume the actual delivery of the metal within the time period specified in the contract. Settlement implies financial offset: if by the time specified in the contract Au has risen in price, then the buyer wins – he/she bought it at a lower price. If the gold spot prices have fallen, the seller wins.

There are other derivatives where gold is the underlying asset (options, spread bets, etc.), but futures contracts trading remains the most popular so far. This is the most straightforward and liquid instrument, which can be sold or bought before its expiration date.

The minimum deposit to enter the gold futures market depends on the type of the traded contracts, target profits, and risk management system. A standard lot for trading gold stocks on the exchange (for example, London metal exchange, New York mercantile exchange, or Shanghai gold exchange) is 100 ounces. So, you will need about 2000 US dollars to open a minimum position of 0.001 lots.

This amount does not take into account the need for a reserve of money to cover the loss. You can use leveraged trading, but stock brokers, unlike Forex brokers, are less generous — the average leverage on the exchange is up to 1:20.

An alternative is E-Mini contracts, they are 0.1 of standard lots. The minimum deposit for the exchange gold futures market remains the same — from 1000-2000 US dollars.

Day Trading Gold

Before covering the peculiarities of intraday gold trading, I will explain the difference between the full lot in trading currency pairs and the full lot in trading gold XAUUSD pair. Understanding how the Forex broker calculates the tick value and the tick movement will help you calculate a potential daily profit based on the average size of the daily candlestick.

How much is one pip of gold?

Forex gold price, which is displayed in the trading platform quotes or in the technical analysis charts, is the price of the troy ounce.

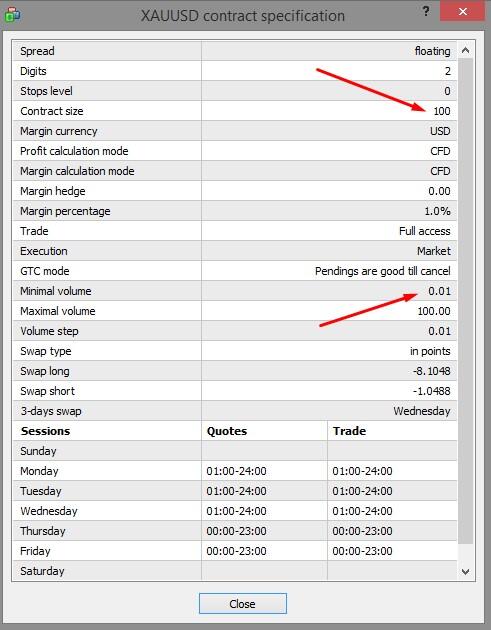

One troy ounce is 31.1 grams. One standard lot is 100 troy ounces, the minimum forex trade volume is 0.01 lots. All these data can be seen in the contract specification. You can find the gold precious metal contract specification in the MT4 in the following way:

- Click on the View menu and select the Symbols. Find the XAUUSD pair and press the Show button.

- Click on the View menu and select the Market Watch. Right-click on the XAUUSD pair and select the Specification tab.

How to calculate the gold pip price in Forex:

- Find the contract size, 100, in the specification.

- Define the pip size (point). Gold quotes in the platform have two decimal places, so the pip, unlike in currency pairs, here will be equal to 0.01.

- Multiply the trade volume by the pip size: 100 * 0.01 = 1 USD.

The minimum XAUUSD price swing by 1 pip (point) corresponds to 1 USD. Differently put, if you buy gold, one troy ounce for 1800 USD, it corresponds to the trade volume of 0.01 lots. And the price movement up to 1805.35 USD will mean that the price has moved by 535 pips.

For 0.01 lot, the pip cost 1/100 = 1 cent, which means that the profit will be 5.35 USD. Accordingly, for 1 full lot, the profit will be 535 USD.

Now, let us get back to the comparison of the XAUUSD and currency pairs in terms of intraday yield.

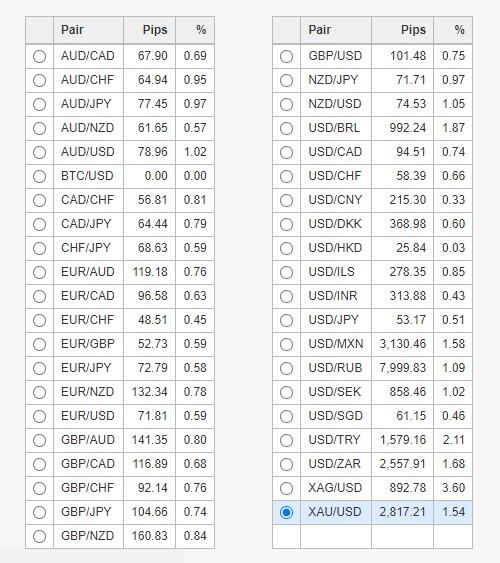

The pip price for the EURUSD is,100,000 * 0.00001 (five-digit quotes), also 1 USD. The average length of the XAUUSD daily candlestick in a non-volatile market is 1000-1500 pips. The average length of a daily EURUSD candlestick is 800-1000 pips. But do not forget about the spread, which is higher for the XAUUSD.

I can draw the following conclusions from this:

- The XAUUSD intraday volatility is relatively similar to currency pairs, provided the gold markets are calm and there are no strong fundamental factors

- XAUUSD has quite low volatility in one-minute timeframes, so it is not suitable for scalping. However, gold usually features a more consistent trend with fewer intraday reversals.

Day trade gold strategy in the H1-H4 timeframes could yield a profit comparable to the profit from currency trading. But the XAUUSD is sensitive to fundamental market forces, the daily movement can expand up to 2500-3000 points and in the direction opposite to your position.

Recommendations on entering XAUUSD trades:

- Enter gold trades in the trend direction, preferably at the beginning of the daily candlestick. If in the daily chart, there a directed movement displayed by two or three candlesticks of the same color, you can spot a trend movement in the hourly chart

- Spot the fundamental movement, do not exit the trades on the local corrections.

- Note the price moves of the correlated underlying assets, silver, and platinum. Using such tools as the gold silver ratio, for example, you can develop gold trading strategies based on the positive correlation. Gold also has a positive correlation with oil quotes and a negative one with the USD.

Gold Trading Best Strategy

Each trading plan is based on a purpose and an idea. A trading gold strategy starts with defining your target, that should define the following points:

- The amount of money you want to earn. You’d better define the target profit in percent of the deposit amount. You can find out how real the target profit is by comparing the percentage with the average annual return on the underlying asset.

- The amount you are willing to invest.

- The investment term. Do you prefer a short-term investment strategy with the ability to quickly cash out the asset? Are you willing to “freeze’ the money for a long time, sacrificing liquidity?

- The trading strategy type you prefer. Do you want to trade gold actively, which will be your primary job, or start passive investment?

- Risk level suggested by the strategy.

Mutual Funds and ETFs are suitable for long-term investment. For a small commission fee, up to 0.5%, a management company will manage your investment. Trading futures contracts or CFD trading in Forex will be suitable for short-term investment.

Strategies for active trading:

1. Scalping. It is rarely used to trade gold. In a few minutes, the price does not have enough time to gain a sufficient move to compensate for the spread and yield a profit comparable to the time spent. There are more profitable scalping trading instruments.

2. Swing trading. Trading on corrections is also really applied to XAUUSD, as the corrections are not deep. Here, trend following strategies are more suitable. However, you can combine swing trading and trend strategies in some cases.

3. Intraday trading. Gold day trading is one of the most common strategy types. Unlike currency pairs, which can many times jump up and down during a day, the gold industry slowly gains speed. However, gold features longer price fluctuations during a day at the moments of fundamental factors’ influence. Differently put, the range of the gold price intraday movements is greater than the currency pairs’ movements. The frequency of the XAUUSD price moves is lower. Below is a screenshot of the average volatility of currency pairs and precious metals over 10 weeks.

4. Medium- and long-term strategies. Positions can be held open for several days if there is a clear trend. But the profits of these strategies are diminished by swaps and exchange commission fees.

5. Technical Indicators strategies. They are trading strategies based on technical analysis. A combination of volatility and trend indicators with multiple timeframes analysis works well here. In an hourly timeframe, the length of the price movement in the intraday range is estimated. If the price is at the beginning of the movement and the trend is clear, you can open a position. You can also add oscillators as auxiliary tools

6. Price Action strategies. They mean trading based on chart patterns and graphic analysis. Since the movement of gold prices is smoother, compared with foreign exchange assets, resistance and support levels are more clearly traced in the chart. Trend exhaustion patterns are a triangle, flag, pennant, etc. Price action patterns trading can be combined with indicator strategies.

7. Trading based on fundamental analysis. The XAUUSD pair is responsive to fundamental market forces. Trading based on fundamentals suggests you find positively or negatively correlated assets. For example, optimism in the stock market means that investors will withdraw the money from gold assets and reinvest into more profitable assets. Negative GDP forecasts, inflation rise, for instance, push the gold price up. You can refer to the Market Sentiment indicator, showing the forecast of the majority.

8. Social trading. Active trading is not only constantly monitoring the price chart and looking for a signal. You can copy trading behavior and signals offered by experienced traders for a small commission fee. In terms of gold trading, you need to choose traders, who enter trades on the XAUUSD more often than other assets. You link your account to the trading account of such traders and signals are automatically copied to your account. You can learn more about this in the article Forex PAMM vs Social Trading. What do investors choose?

Peculiarities of trading the XAUUSD:

High level of liquidity no matter with what instruments you trade gold online. The exception is physical gold bars, but they can be quickly sold if a trader agrees with a high margin.