What is a Gamma Squeeze?

A gamma squeeze is a sharp jump in the stock value in a short time caused by the fact that large investors are forced to buy more stocks to hedge their call options positions. Gamma squeeze and short squeeze are often used as synonyms in many sources. However, there are key differences between these terms.

How a Gamma Squeeze Works

First, you need to understand what a short squeeze is. A short squeeze is a situation when many investors are forced to buy stocks simultaneously to close short trades, which increases the demand and stock price.

Short squeeze works as follows:

- A trader opens a short trade on a stock, borrows stocks from a broker against cash collateral, and sells them at the current price. In fact, the trader does not own the stock and must buy it in the future to pay off the debt. The process is based on the assumption that the stocks will fall in price, and the trader will buy them at a lower price and repay the debt.

- For one reason or another, stocks begin to rise in price, and short traders quickly lose money. When the cash collateral becomes insufficient, the broker closes the short trade, buys the stocks with the trader’s collateral, and closes the debt (closing the trade by stop-out). Or the trader closes the deal ahead of schedule without bringing the situation to an even greater loss.

- The additional volume of purchases that appeared due to the forced closing of short trades increases demand, while large trading volumes push the price up even faster.

A short squeeze is a mass closing of short trades by stop loss and stop out due to a sharp increase in an asset’s value. Gamma squeeze occurs in a similar way, but has a key difference. A short squeeze appears on the market where stocks are directly traded. Gamma squeeze appears on the derivatives market, that is, the options market.

To understand what causes the gamma squeeze, I will describe an options trading model. Some of the definitions are presented below:

- An option is a contract that gives the buyer the right (but not the obligation) to trade the underlying asset (stocks in particular). A call option gives the buyer the right to buy stocks in the future, while a put option allows the buyer to sell stocks at the strike price in the future.

- The strike price is the option exercise price specified in the option contract. The price at which the buyer of a call option will buy the stock from the seller at expiration, regardless of the current price.

- The premium is a fixed amount that the buyer of an option pays for a trade.A trader who buys a call option expects higher stock prices. A trader who buys a put option expects the stock price to fall.

- Example. Now the stock of company A is worth 100 USD. The trader understands that the stock price will rise to 120 USD in a month. He wants to buy 50 stocks but doesn’t have 5000 USD (50*100 USD). Then he buys a call option for a small premium (30 USD), which gives him the right to buy 50 stocks in a month at a strike price of 100 USD. The seller will be obliged to sell him these stocks. If the stock rises to 120 USD, the seller will suffer losses, and the buyer will profit. If the stocks fall in price, the contract does not make sense to execute since the seller earns a 30 USD premium, and the buyer loses 30 USD.

- Delta shows how much the option price will move relative to a move in the underlying asset. For example, if a stock has risen in price by 1 USD, while a call option by 10 cents, then the Delta coefficient is 0.1 or 10%. For a call option, the delta is positive, and for a put option, it is negative.The price of a call option depends on the strike of the contract, (and) the current price. The higher the current price relative to the strike, the more expensive the option. In this way, the profit of buyers who, by the expiration of the option contract, want to buy stocks at a predetermined lower strike price, will be greater. Also, the option price is affected by the expiration date – the closer it is, the more likely it will be executed.Below is a diagram of the option price change dependence on the underlying stock price:

- Gamma is related to the delta, as it measures how the latter changes as a stock’s price shifts up or down.The “gamma squeeze” comes from the name of the gamma coefficient.

- Hedging is risk insurance by market makers, which consists in opening opposite positions on the underlying asset.If a trader buys a call option, then a market maker acts as the seller of the option who can influence stock prices. To partially insure against a possible loss if an option is executed, a market maker must hedge his position. Only part of the position is hedged. If the market maker sells a call option to the buyer, he loses money if the stock price rises but partially compensates for the loss due to the purchased stocks.

- Example. The call option’s strike price is 150 USD, and the current price is 100 USD. In this situation, the loss in the premium amount is borne by the option buyer since the option has not yet reached the strike. The market maker, assessing the potential for price growth, calculates the number of stocks that need to be bought to insure against price growth. The stock rate is rising. The closer the current price is to the strike, the higher the probability that the option will be executed and the market maker will have to sell the stocks at a loss. The higher the risk for a market maker to execute an option, the more he needs to buy stocks to hedge. If the price crosses the strike level and rises even higher, the buyer will present the option by the end of expiration for execution with 100% probability. Thus, the position must be 100% insured.

The essence of gamma squeeze. When market makers realize there is little to no chance of a price increase, they easily sell call options. In a falling market, the risk is minimal, so the hedging amount is small. However, the market grows contrary to the forecast, and investors buy stocks instead of selling.

An increase in the already large number of market participants buying call options increases the risks and forces market makers to increase the hedging rate due to the growth of delta and gamma coefficients. Market makers are forced to buy additional stocks on the market. But additional volumes again push the price up, the coefficients change again, and market makers are again forced to buy more securities. This is where the gamma squeeze occurs, sharply pushing the rate up. When the option expires, the market maker sells the stocks, and their price plummets.

Gamma Squeeze Examples

Gamma squeezes are more common in stocks of relatively small companies since the securities of large companies are more difficult to manipulate. Nevertheless, in the stock market’s history, there are examples of gamma squeezes of well-known companies whose stocks grew by more than 500-1000% during a squeeze.

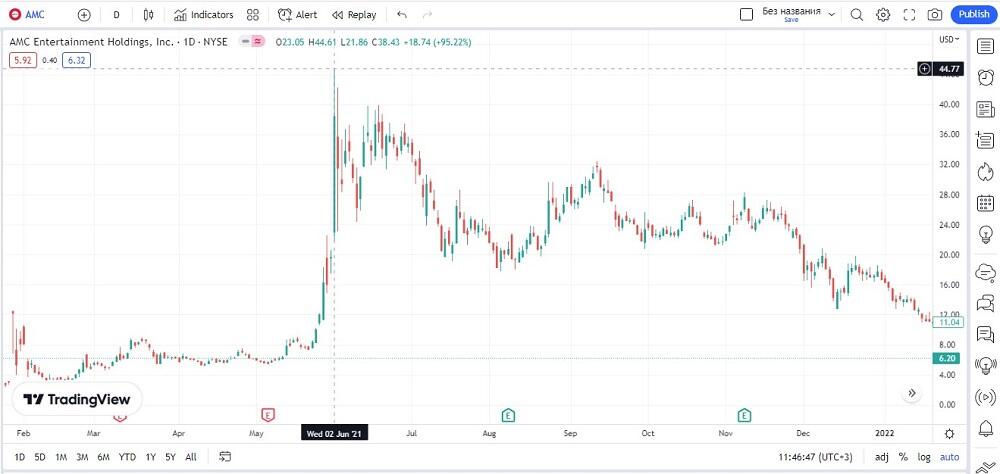

AMC Gamma Squeeze Explained

In January 2021, the management of the AMC Entertainment Holdings cinema chain drew the investor community’s attention to the possible initiation of bankruptcy proceedings. The entertainment industry has been hit hard by COVID-19, and the once-largest chain in the world has been in crisis for a long time.

The popular Reddit community of Wall Street Bets has become an unexpected way to rescue AMC Entertainment. It is a movement against hedge funds and Wall Street institutional investors who sell stocks of failing companies en masse, pushing them into bankruptcy even faster.

The rescue of AMC Entertainment included the following steps:

- Major investors, who received a signal from the top management of the network at the beginning of 2021 about structural problems, began to bet massively on short stocks. The number of short trades and put options increased.

- The renewal of the partnership with Universal (which at the time had been put on hold due to controversy) gave AMC Entertainment little hope. The news that AMC Entertainment managed to raise 917 million investments led to an increase in the price by 245% (to 17.36 USD per stock) on January 25, 2021. This was one of the signals to start putting pressure on sellers.

- The Reddit community began encouraging traders to buy AMC Entertainment stocks in May. Mass purchases by retail investors have led to the fact that market makers who bet on the fall were forced to add up to hedging positions on call options.